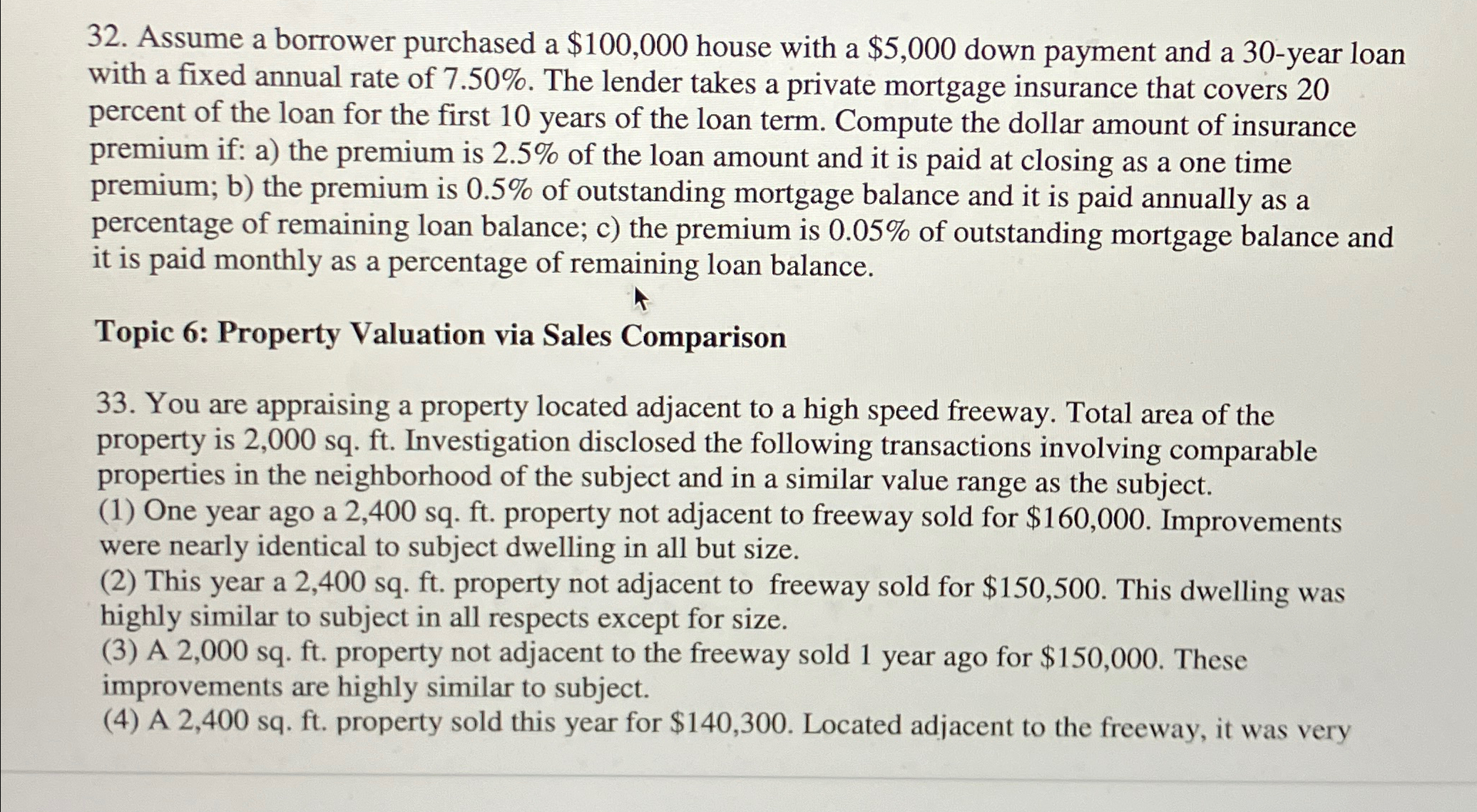

Question: Assume a borrower purchased a $ 1 0 0 , 0 0 0 house with a $ 5 , 0 0 0 down payment and

Assume a borrower purchased a $ house with a $ down payment and a year loan with a fixed annual rate of The lender takes a private mortgage insurance that covers percent of the loan for the first years of the loan term. Compute the dollar amount of insurance premium if: a the premium is of the loan amount and it is paid at closing as a one time premium; b the premium is of outstanding mortgage balance and it is paid annually as a percentage of remaining loan balance; c the premium is of outstanding mortgage balance and it is paid monthly as a percentage of remaining loan balance.

Topic : Property Valuation via Sales Comparison

You are appraising a property located adjacent to a high speed freeway. Total area of the property is sq ft Investigation disclosed the following transactions involving comparable properties in the neighborhood of the subject and in a similar value range as the subject.

One year ago a sq ft property not adjacent to freeway sold for $ Improvements were nearly identical to subject dwelling in all but size.

This year a sq ft property not adjacent to freeway sold for $ This dwelling was highly similar to subject in all respects except for size.

A sq ft property not adjacent to the freeway sold year ago for $ These improvements are highly similar to subject.

A sq ft property sold this year for $ Located adjacent to the freeway, it was very

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock