Question: Assume a flat term structure with all spot rates equal to 5%. Consider a five-year coupon bond with a face value of $100 and an

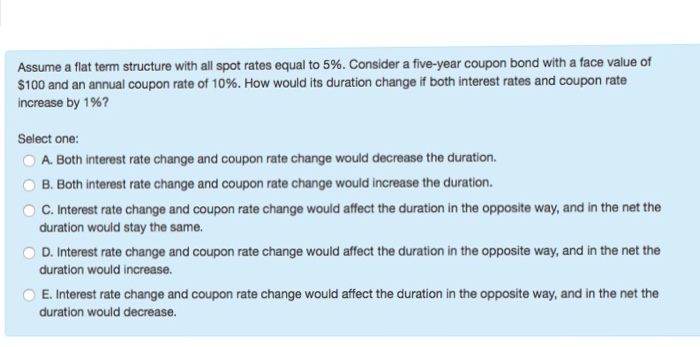

Assume a flat term structure with all spot rates equal to 5%. Consider a five-year coupon bond with a face value of $100 and an annual coupon rate of 10%. How would its duration change if both interest rates and coupon rate increase by 1 %? Select one: A. Both interest rate change and coupon rate change would decrease the duration. B. Both interest rate change and coupon rate change would increase the duration. C. Interest rate change and coupon rate change would affect the duration in the opposite way, and in the net the duration would stay the same. D. Interest rate change and coupon rate change would affect the duration in the opposite way, and in the net the duration would increase. E. Interest rate change and coupon rate change would affect the duration in the opposite way. and in the net the duration would decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts