Question: everything is given D Question 19 10 pts A bond in ALFA and a bond in DELTA both have maturity of 5 years and a

everything is given

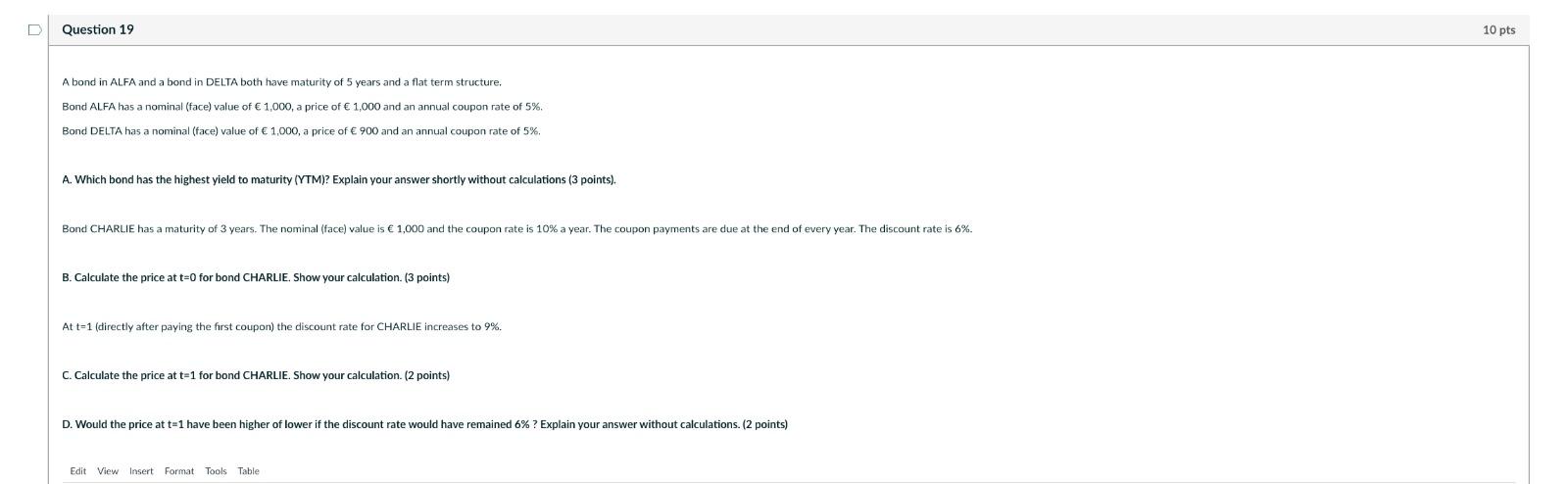

D Question 19 10 pts A bond in ALFA and a bond in DELTA both have maturity of 5 years and a flat term structure, Bond ALFA has a nominal (face) value of 1,000, a price of 1,000 and an annual coupon rate of 5%, Bond DELTA has a nominal (face) value of 1,000, a price of 900 and an annual coupon rate of 5% A. Which bond has the highest yield to maturity (YTM)? Explain your answer shortly without calculations (3 points). Bond CHARLIE has a maturity of 3 years. The nominal (face) value is 1,000 and the coupon rate is 10% a year. The coupon payments are due at the end of every year. The discount rate is 6%. B. Calculate the price at t=0 for bond CHARLIE. Show your calculation. (3 points) At t=1 (directly after paying the first coupon) the discount rate for CHARLIE increases to 9%. C. Calculate the price at t=1 for bond CHARLIE. Show your calculation. (2 points) D. Would the price at t=1 have been higher of lower if the discount rate would have remained 6% ? Explain your answer without calculations. (2 points) Edit View Insert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts