Question: Assume a one-period binomial model framework. You are given the following regarding Microsoft stock: Microsoft share price currently sells for $60 per share. Six

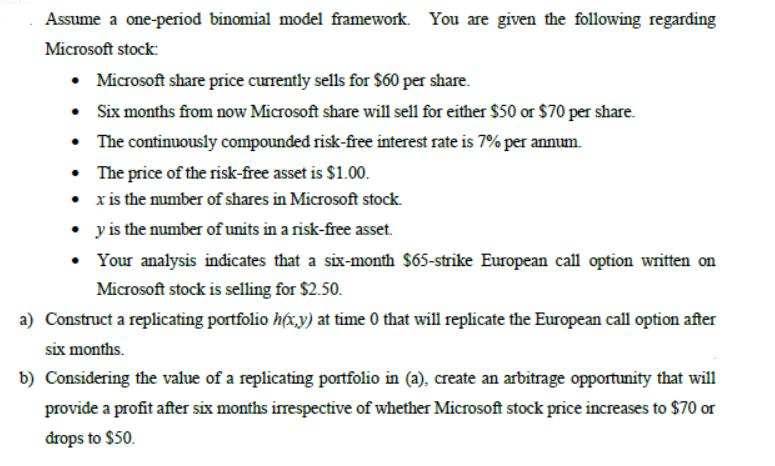

Assume a one-period binomial model framework. You are given the following regarding Microsoft stock: Microsoft share price currently sells for $60 per share. Six months from now Microsoft share will sell for either $50 or $70 per share. The continuously compounded risk-free interest rate is 7% per annum. The price of the risk-free asset is $1.00. x is the number of shares in Microsoft stock. y is the number of units in a risk-free asset. Your analysis indicates that a six-month $65-strike European call option written on Microsoft stock is selling for $2.50. a) Construct a replicating portfolio h(x,y) at time 0 that will replicate the European call option after six months. b) Considering the value of a replicating portfolio in (a), create an arbitrage opportunity that will provide a profit after six months irrespective of whether Microsoft stock price increases to $70 or drops to $50.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

To solve this problem we will follow the principles of noarbitrage valuation and use the binomial model to value the option and construct a replicating portfolio In a oneperiod binomial model with two ... View full answer

Get step-by-step solutions from verified subject matter experts