Question: Assume all rates are per annum continuously compounded Consider a European put option on Google with strike price $380.00 expiring in 17 months. Suppose that

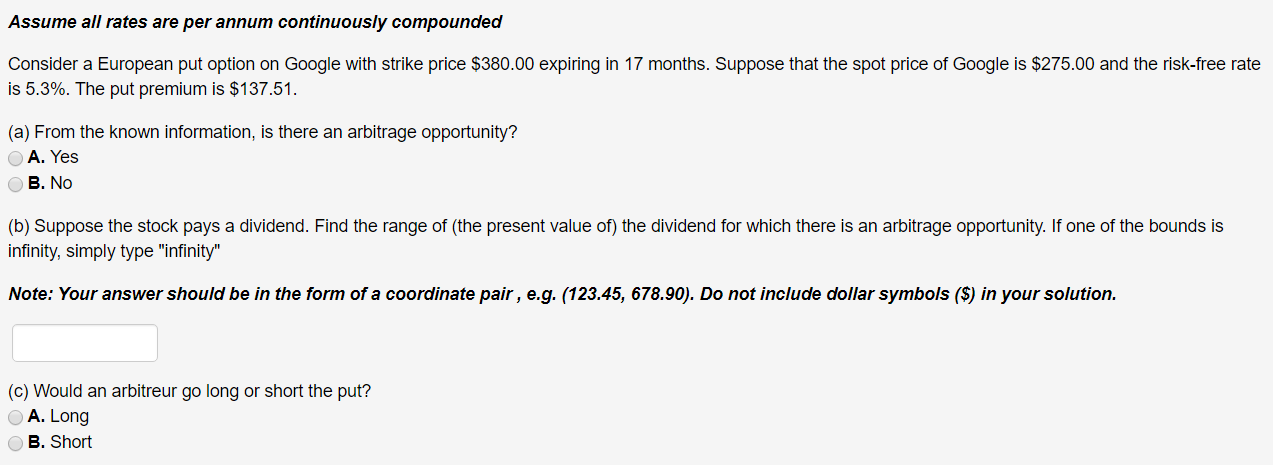

Assume all rates are per annum continuously compounded Consider a European put option on Google with strike price $380.00 expiring in 17 months. Suppose that the spot price of Google is $275.00 and the risk-free rate is 5.3%. The put premium is $137.51. (a) From the known information, is there an arbitrage opportunity? O A. Yes B. No (b) Suppose the stock pays a dividend. Find the range of the present value of) the dividend for which there is an arbitrage opportunity. If one of the bounds is infinity, simply type "infinity" Note: Your answer should be in the form of a coordinate pair , e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution. (c) Would an arbitreur go long or short the put? A. Long B. Short Assume all rates are per annum continuously compounded Consider a European put option on Google with strike price $380.00 expiring in 17 months. Suppose that the spot price of Google is $275.00 and the risk-free rate is 5.3%. The put premium is $137.51. (a) From the known information, is there an arbitrage opportunity? O A. Yes B. No (b) Suppose the stock pays a dividend. Find the range of the present value of) the dividend for which there is an arbitrage opportunity. If one of the bounds is infinity, simply type "infinity" Note: Your answer should be in the form of a coordinate pair , e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution. (c) Would an arbitreur go long or short the put? A. Long B. Short

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts