Question: Question 9 (3.03 points) Hilton Co. is expecting to pay 250,000 Canadian dollars (C$) in one year. Hilton expects the spot rate of Canadian dollar

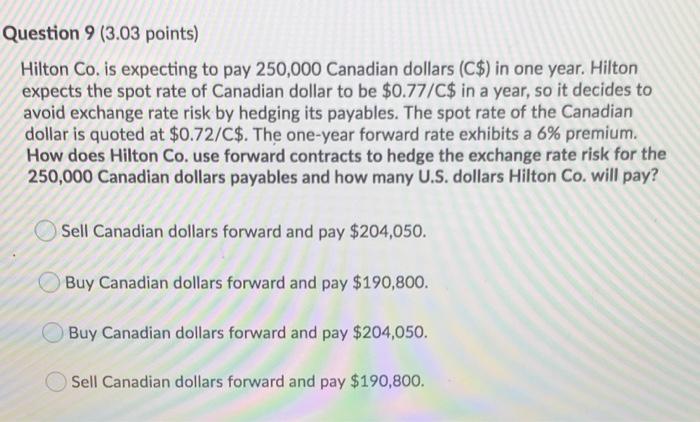

Question 9 (3.03 points) Hilton Co. is expecting to pay 250,000 Canadian dollars (C$) in one year. Hilton expects the spot rate of Canadian dollar to be $0.77/C$ in a year, so it decides to avoid exchange rate risk by hedging its payables. The spot rate of the Canadian dollar is quoted at $0.72/C$. The one-year forward rate exhibits a 6% premium. How does Hilton Co. use forward contracts to hedge the exchange rate risk for the 250,000 Canadian dollars payables and how many U.S. dollars Hilton Co. will pay? Sell Canadian dollars forward and pay $204,050. Buy Canadian dollars forward and pay $190,800. Buy Canadian dollars forward and pay $204,050. Sell Canadian dollars forward and pay $190,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts