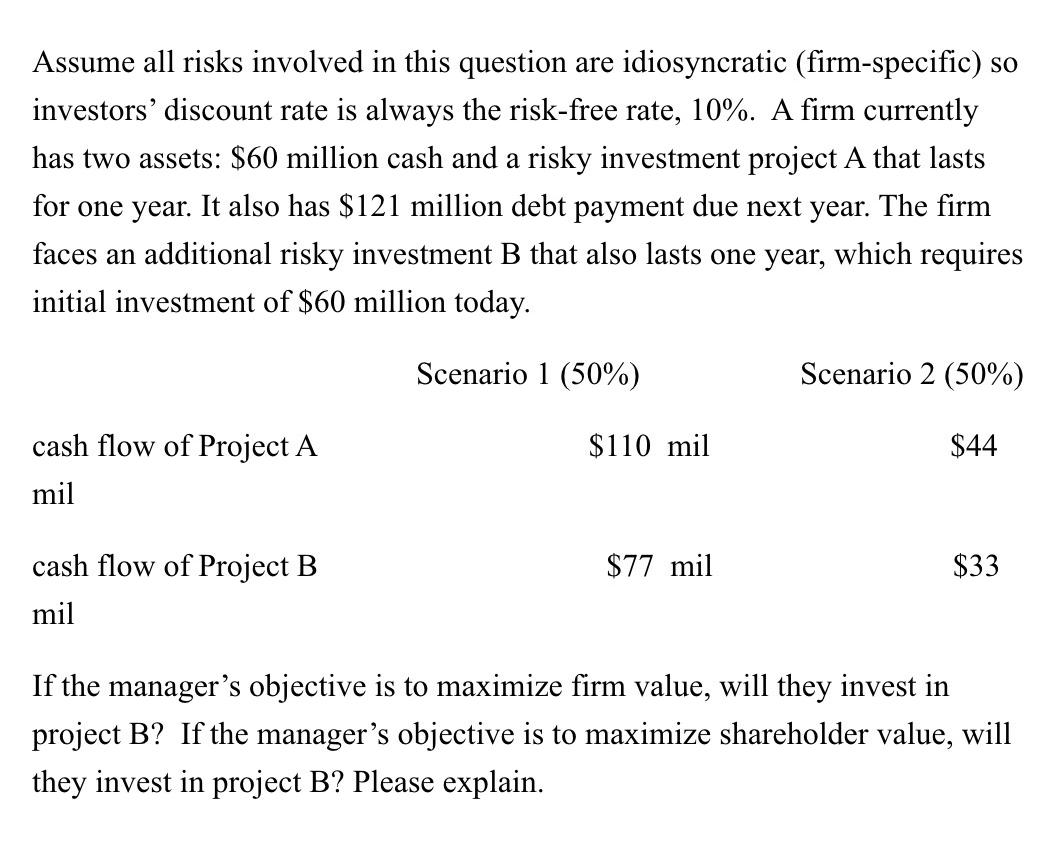

Question: Assume all risks involved in this question are idiosyncratic ( firm - specific ) so investors' discount rate is always the risk - free rate,

Assume all risks involved in this question are idiosyncratic firmspecific so investors' discount rate is always the riskfree rate, A firm currently has two assets: $ million cash and a risky investment project A that lasts for one year. It also has $ million debt payment due next year. The firm faces an additional risky investment that also lasts one year, which requires initial investment of $ million today.

Scenario

cash flow of Project A mil

cash flow of Project B mil

$mil

$ mil

Scenario

$

$

If the manager's objective is to maximize firm value, will they invest in project If the manager's objective is to maximize shareholder value, will they invest in project B Please explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock