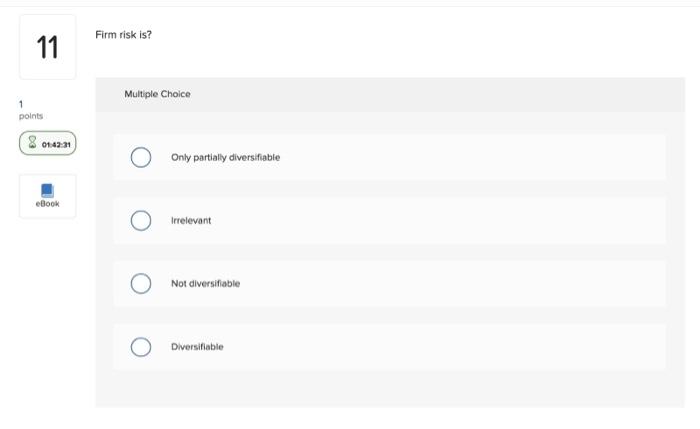

Question: Firm risk is? 11 Multiple Choice points 8 01:42:21 Only partially diversifiable Book Irrelevant Not diversifiable Diversiflable You have forecast the cash flows on a

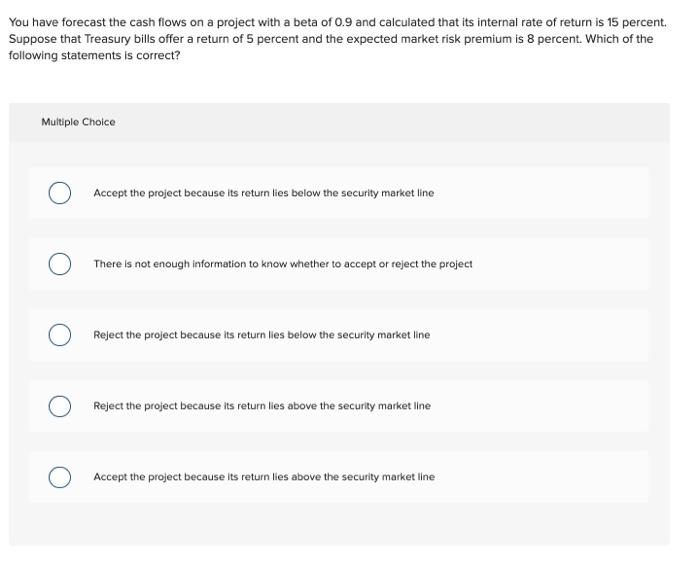

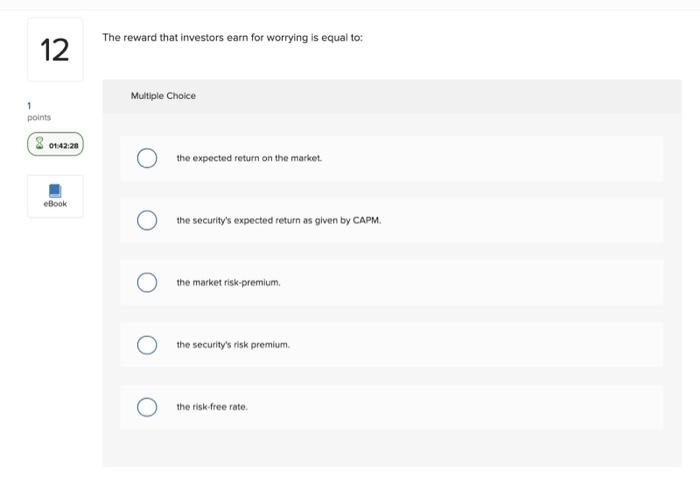

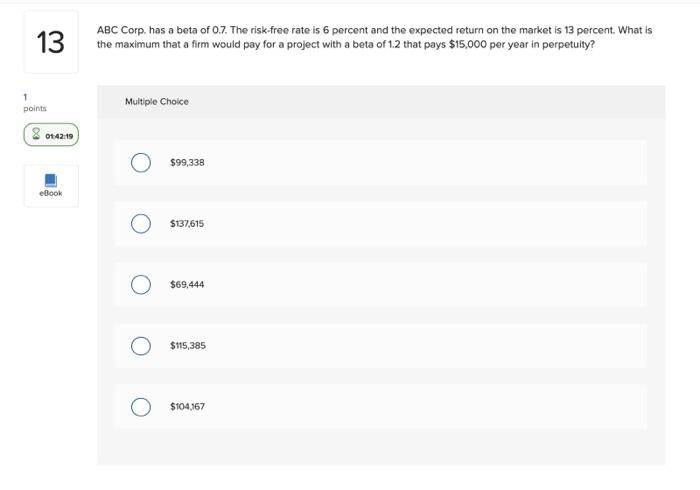

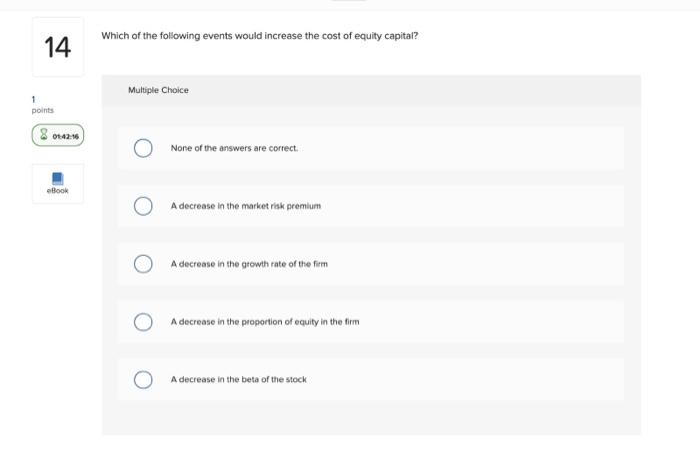

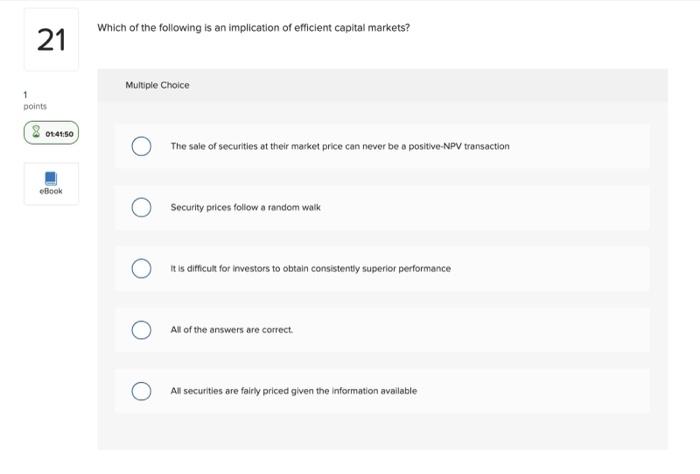

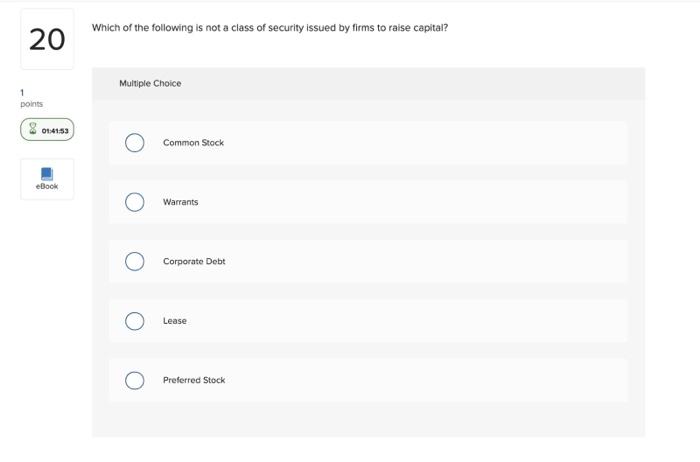

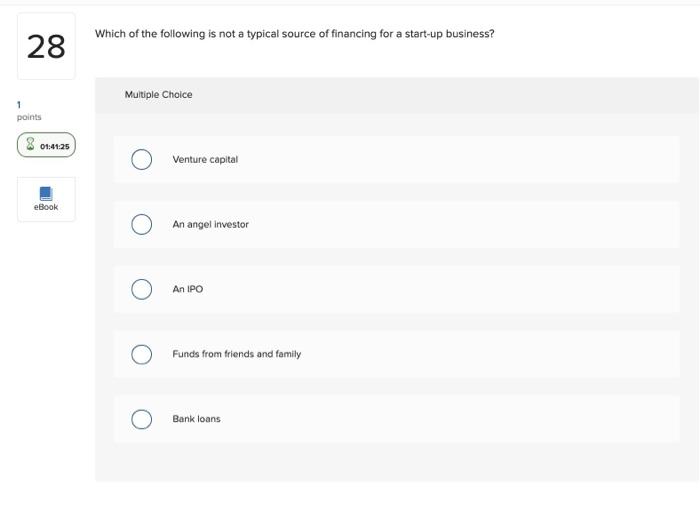

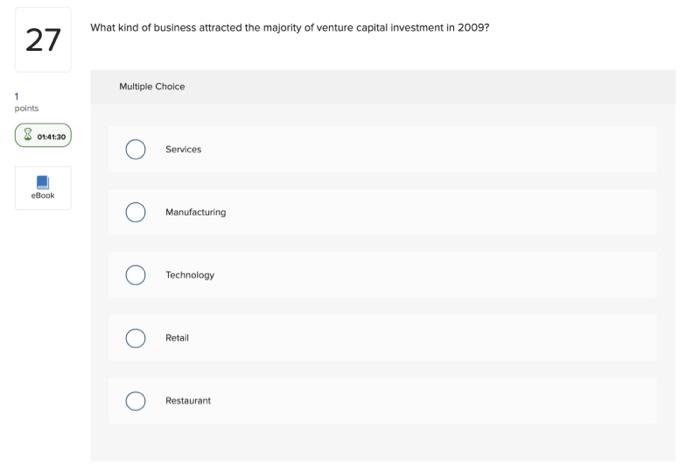

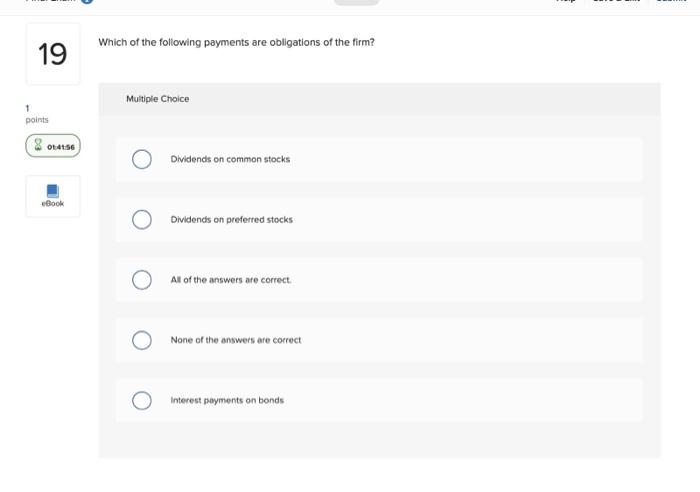

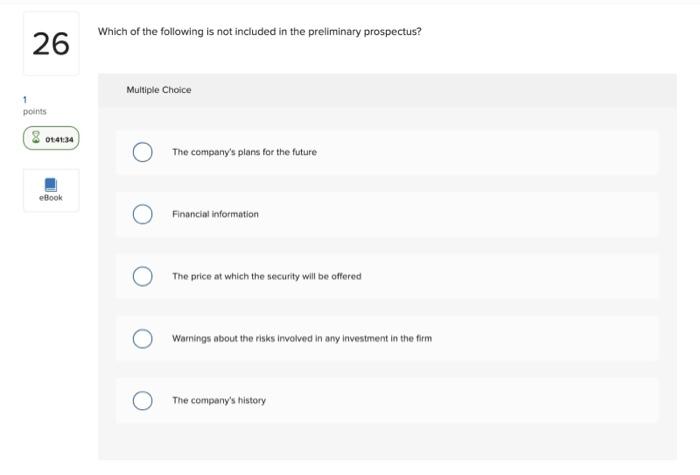

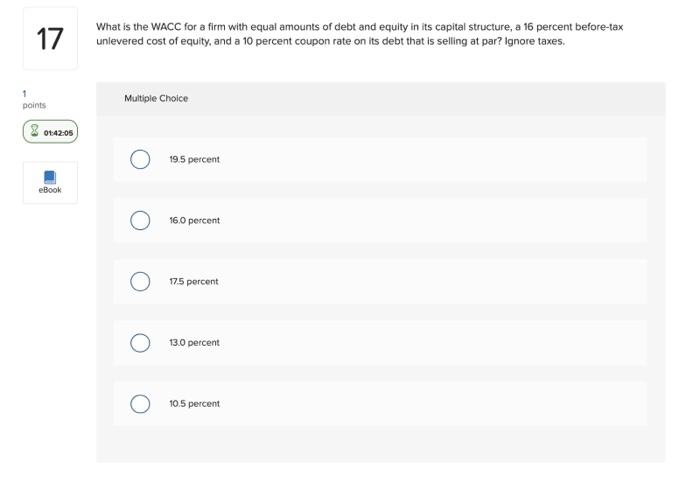

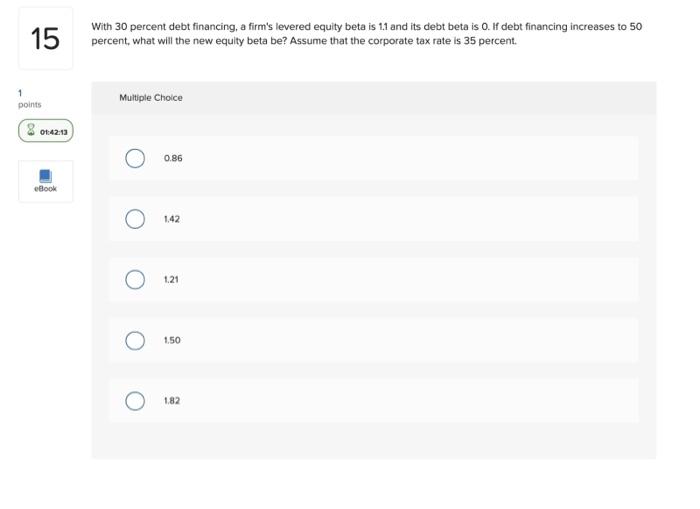

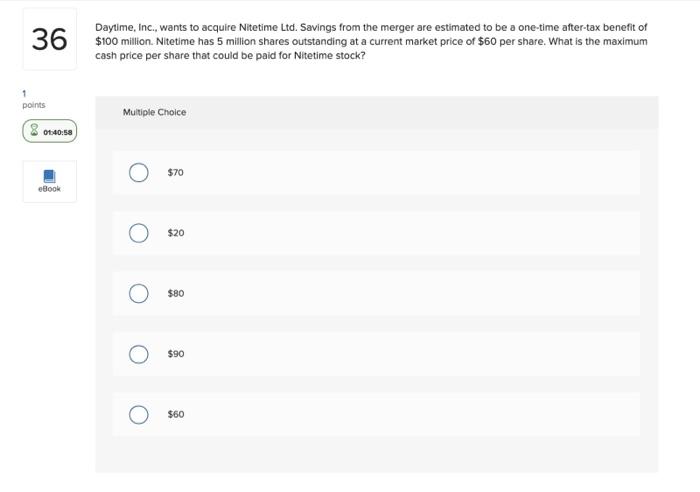

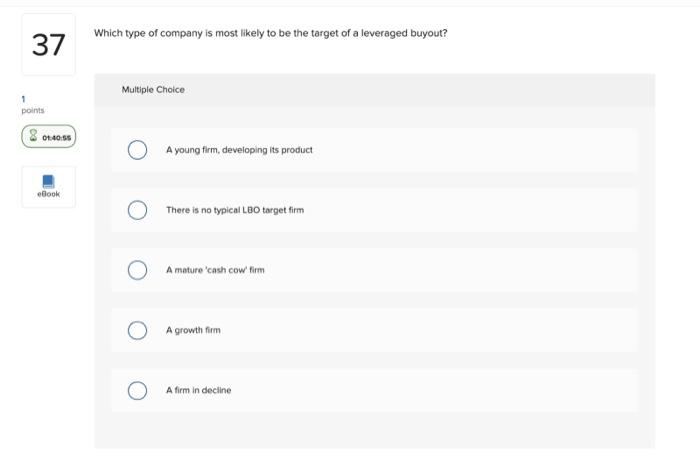

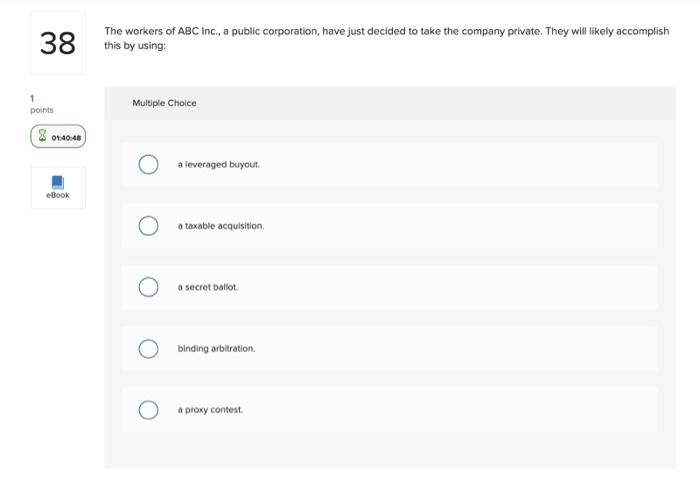

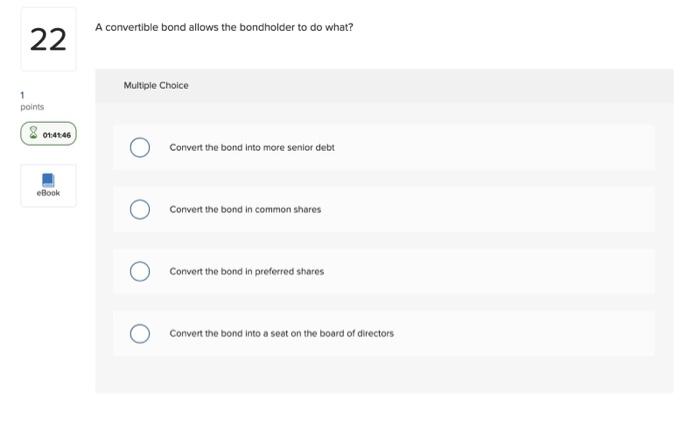

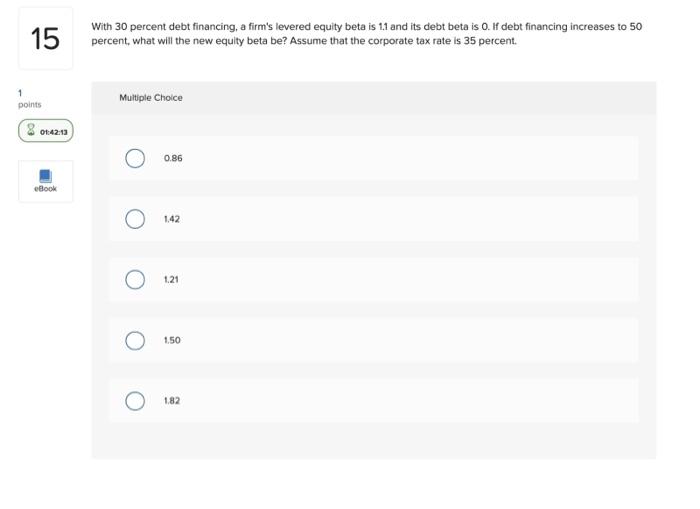

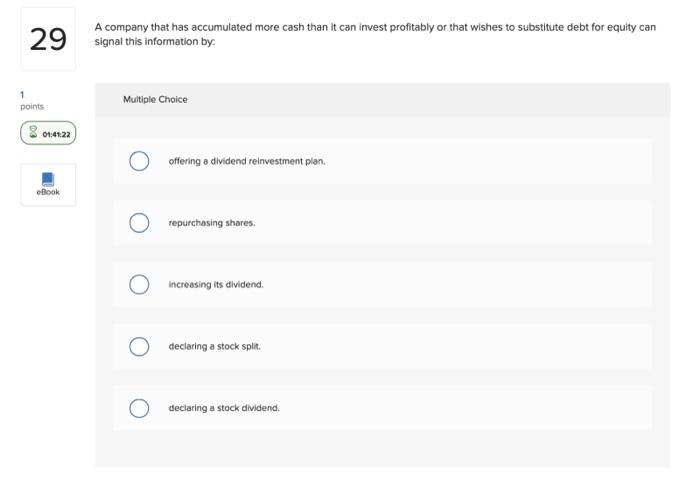

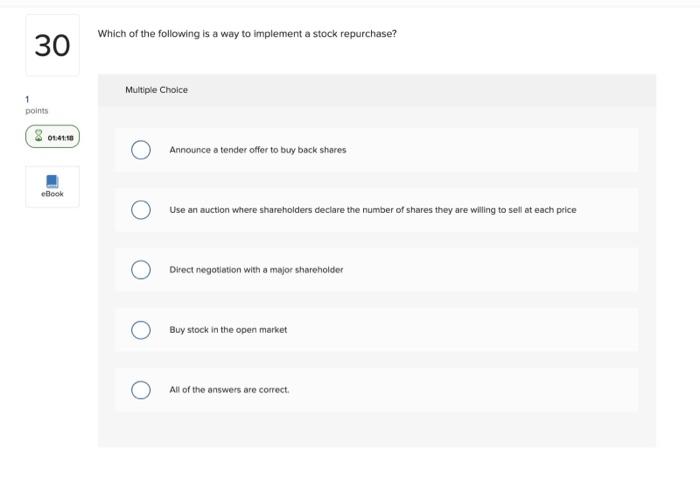

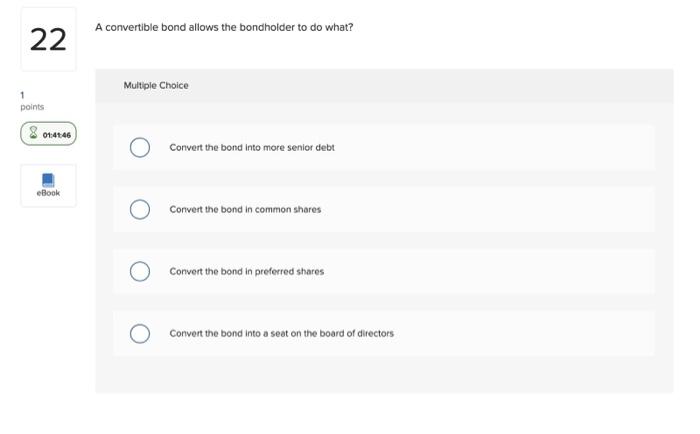

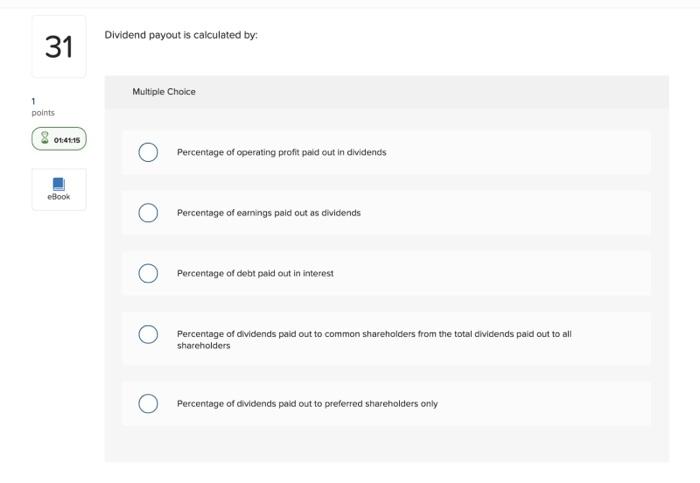

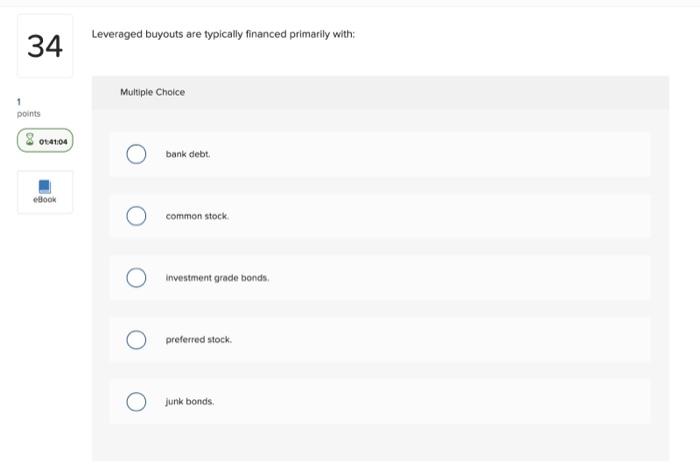

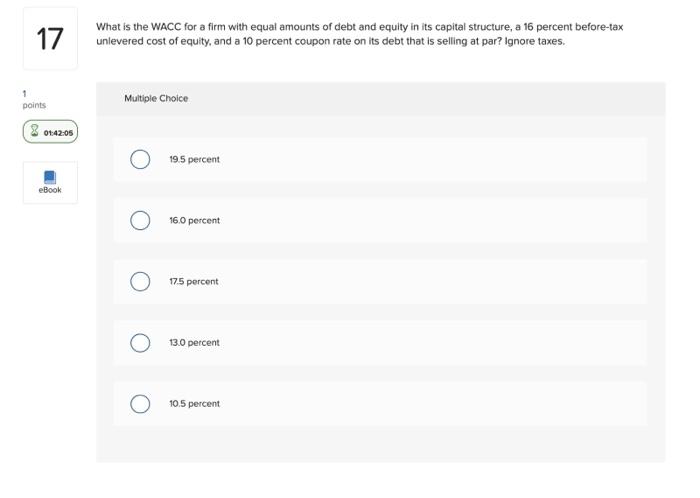

Firm risk is? 11 Multiple Choice points 8 01:42:21 Only partially diversifiable Book Irrelevant Not diversifiable Diversiflable You have forecast the cash flows on a project with a beta of 0.9 and calculated that its internal rate of return is 15 percent. Suppose that Treasury bills offer a return of 5 percent and the expected market risk premium is 8 percent. Which of the following statements is correct? Multiple Choice Accept the project because its return lies below the security market line There is not enough information to know whether to accept or reject the project Reject the project because its return lies below the security market line Reject the project because its return lies above the security market line Accept the project because its return lies above the security market line The reward that investors earn for worrying is equal to: 12 Multiple Choice 1 points 8 01:42:28 the expected return on the market. eBook the security's expected return as given by CAPM. the market risk-premium the security's risk premium the risk free rate 13 ABC Corp. has a beta of 07. The risk-free rate is 6 percent and the expected return on the market is 13 percent. What is the maximum that a firm would pay for a project with a beta of 1.2 that pays $15,000 per year in perpetuity? 1 Multiple Choice points 8 004219 $99,338 eBook $137,615 $69.444 $115,385 $104,167 Which of the following events would increase the cost of equity capital? 14 Multiple Choice 1 points 8 01:42:46 None of the answers are correct. Book A decrease in the market risk premium A decrease in the growth rate of the firm A decrease in the proportion of equity in the firm A decrease in the beta of the stock Which of the following is an implication of efficient capital markets? 21 Multiple Choice 1 points 804150 The sale of securities at their market price can never be a positive-NPV transaction Book Security prices follow a random walk it is difficult for investors to obtain consistently superior performance All of the answers are correct All securities are fairly priced given the information available Which of the following is not a class of security issued by firms to raise capital? 20 Multiple Choice 1 points 8 01:41:53 Common Stock eBook O Warrants Corporate Debt Lease Preferred Stock Which of the following is not a typical source of financing for a start-up business? 28 Multiple Choice points 01:41:25 Venture capital eBook An angel investor O An IPO Funds from friends and family Bank loans What kind of business attracted the majority of venture capital investment in 2009? 27 Multiple Choice points 8 0644:30 Services eBook Manufacturing Technology Retail Restaurant Which of the following payments are obligations of the firm? 19 Multiple Choice 1 points 8004736 Dividends on common stocks eBook Dividends on preferred stocks All of the answers are correct None of the answers are correct Interest payments on bonds Which of the following is not included in the preliminary prospectus? 26 Multiple Choice 1 points 8054134 The company's plans for the future eBook Financial information The price at which the security will be offered Warnings about the risks involved in any investment in the firm The company's history 17 What is the WACC for a firm with equal amounts of debt and equity in its capital structure, a 16 percent before-tax unlevered cost of equity, and a 10 percent coupon rate on its debt that is selling at par? Ignore taxes. 1 points Multiple Choice 8 0142:05 19.5 percent eBook 16.0 percent 175 percent 13.0 percent 10.5 percent 15 With 30 percent debt financing, a firm's levered equity beta is 1.1 and its debt beta is 0. If debt financing increases to 50 percent, what will the new equity beta be? Assume that the corporate tax rate is 35 percent. 1 points Multiple Choice 801420 0.86 eBook O 1.42 1.21 1.50 1.82 Daytime, Inc., wants to acquire Nitetime Ltd. Savings from the merger are estimated to be a one-time after-tax benefit of 36 $100 million. Nitetime has 5 million shares outstanding at a current market price of $60 per share. What is the maximum cash price per share that could be paid for Nitetime stock? 1 points Multiple Choice 8 00:40:58 O $70 eBook O $20 O $80 $90 $60 O Which type of company is most likely to be the target of a leveraged buyout? 37 Multiple Choice 1 points 8 10:55 A young firm, developing its product eBook There is no typical LBO target firm A maturo cash cow firm A growth firm A firm in decline The workers of ABC Inc., a public corporation, have just decided to take the company private. They will likely accomplish 38 this by using 1 points Multiple Choice 8 014048 a leveraged buyout. eBook O a taxable acquisition a secret ballot binding arbitration a proxy contest A convertible bond allows the bondholder to do what? 22 Multiple Choice 1 points 8014746 Convert the bond into more senior debt eBook Convert the bond in common shares Convert the bond in preferred shares Convert the bond into a seat on the board of directors 15 With 30 percent debt financing, a firm's levered equity beta is 1.1 and its debt beta is 0. If debt financing increases to 50 percent, what will the new equity beta be? Assume that the corporate tax rate is 35 percent. 1 points Multiple Choice 801420 0.86 eBook O 1.42 1.21 1.50 1.82 A company that has accumulated more cash than it can invest profitably or that wishes to substitute debt for equity car 29 signal this information by 1 points Multiple Choice 8 01:48:22 offering a dividend reinvestment plan. eBook repurchasing shares Increasing its dividend declaring a stock split. declaring a stock dividend. Which of the following is a way to implement a stock repurchase? 30 Multiple Choice 1 points 8 0410 01:41:10 Announce a tender offer to buy back shares eBook O Use an auction where shareholders declare the number of shares they are willing to sell at each price Direct negotiation with a major shareholder Buy stock in the open market All of the answers are correct A convertible bond allows the bondholder to do what? 22 Multiple Choice 1 points 8014746 Convert the bond into more senior debt eBook Convert the bond in common shares Convert the bond in preferred shares Convert the bond into a seat on the board of directors Dividend payout is calculated by: 31 Multiple Choice 1 points 8 14:15 Percentage of operating profit paid out in dividends eBook Percentage of eamings paid out as dividends O Percentage of debt paid out in interest Percentage of dividends paid out to common shareholders from the total dividends paid out to all shareholders Percentage of dividends paid out to preferred shareholders only Leveraged buyouts are typically financed primarily with: 34 Multiple Choice 1 points 8 0641104 bank debt. Book common stock Investment grade bonds preferred stock junk bonds 17 What is the WACC for a firm with equal amounts of debt and equity in its capital structure, a 16 percent before-tax unlevered cost of equity, and a 10 percent coupon rate on its debt that is selling at par? Ignore taxes. 1 points Multiple Choice 8 0142:05 19.5 percent eBook 16.0 percent 175 percent 13.0 percent 10.5 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts