Question: Assume instead Maritza was in a PPO plan with a $800 deductible, $4,500 00PM. The PPO has the same copayments PCP, but a $50 copayment

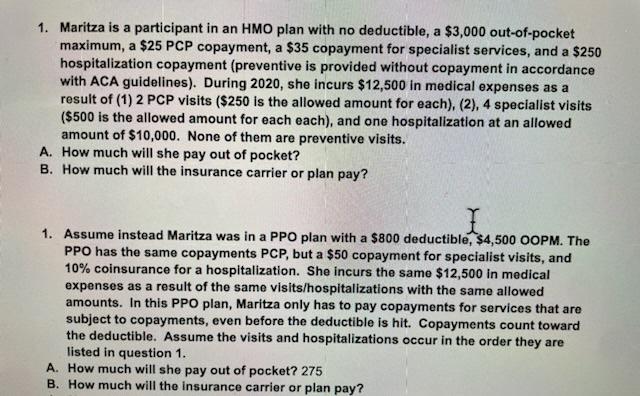

1. Maritza is a participant in an HMO plan with no deductible, a $3,000 out-of-pocket maximum, a $25 PCP copayment, a $35 copayment for specialist services, and a $250 hospitalization copayment (preventive is provided without copayment in accordance with ACA guidelines). During 2020, she incurs $12,500 in medical expenses as a result of (1) 2 PCP visits ($250 is the allowed amount for each), (2), 4 specialist visits ($500 is the allowed amount for each each), and one hospitalization at an allowed amount of $10,000. None of them are preventive visits. A. How much will she pay out of pocket? B. How much will the insurance carrier or plan pay? 1. Assume instead Maritza was in a PPO plan with a $800 deductible, $4,500 OOPM. The PPO has the same copayments PCP, but a $50 copayment for specialist visits, and 10% coinsurance for a hospitalization. She incurs the same $12,500 in medical expenses as a result of the same visits/hospitalizations with the same allowed amounts. In this PPO plan, Maritza only has to pay copayments for services that are subject to copayments, even before the deductible is hit. Copayments count toward the deductible. Assume the visits and hospitalizations occur in the order they are listed in question 1. A. How much will she pay out of pocket? 275 B. How much will the insurance carrier or plan pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts