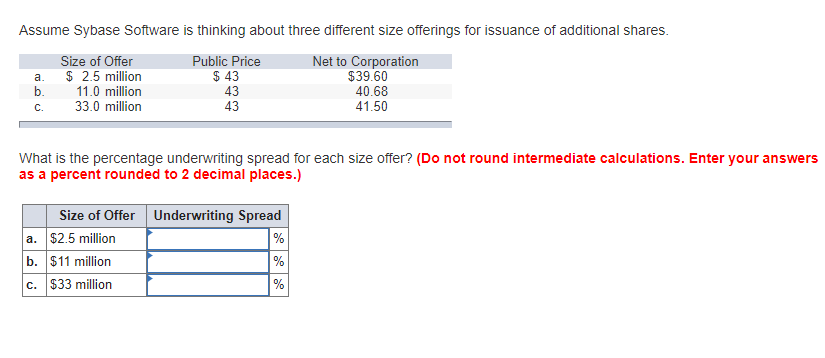

Question: Assume Sybase Software is thinking about three different size offerings for issuance of additional shares. What is the percentage underwriting spread for each size offer?

Assume Sybase Software is thinking about three different size offerings for issuance of additional shares. What is the percentage underwriting spread for each size offer? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts