Question: complete the problems using Excel formula P-6: Underwriting Spread (LO15-2) Solar Energy Corp, has $4 million in earnings with four million shares outstanding. Investment bankers

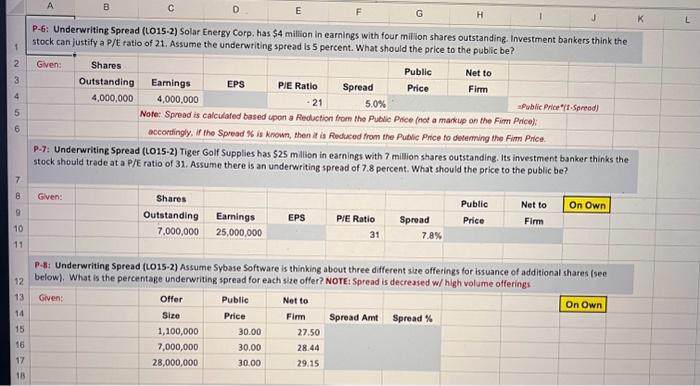

P-6: Underwriting Spread (LO15-2) Solar Energy Corp, has $4 million in earnings with four million shares outstanding. Investment bankers think the stock can justify a P/E ratio of 21 . Assume the underwriting spread is 5 percent. What should the price to the public be? Nore: spread is calculafed based upon a Reduction from the Public Phice (not a mankup an the Fim Price): accordingly, if the Spread K is known, then it is Reduced from the Public Price fo deteming the Fimm Price. P-7: Underwriting Spread (LO15-2) Tiger Golf Supplies has 525 million in earnings with 7 million shares outstanding. Its investment banker thinks the stock should trade at a P/E ratio of 31 . Assume there is an underwriting spread of 7.8 percent. What should the price to the public be? P-8: Underwriting Spread (LO15-2) Assume Sybase Software is thinking about three different size offerings for issuance of additional shares (see below). What is the percentage underwriting spread for each site offer? NorE: Spread is decreased w/ high volume offerings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts