Question: Assume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to double its depreciation expense for the upcoming year but

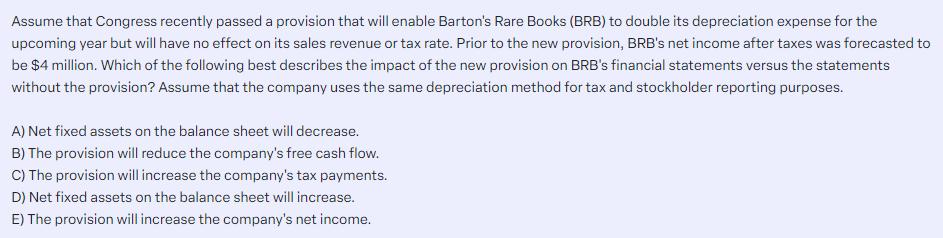

Assume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to double its depreciation expense for the upcoming year but will have no effect on its sales revenue or tax rate. Prior to the new provision, BRB's net income after taxes was forecasted to be $4 million. Which of the following best describes the impact of the new provision on BRB's financial statements versus the statements without the provision? Assume that the company uses the same depreciation method for tax and stockholder reporting purposes. A) Net fixed assets on the balance sheet will decrease. B) The provision will reduce the company's free cash flow. C) The provision will increase the company's tax payments. D) Net fixed assets on the balance sheet will increase. E) The provision will increase the company's net income.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below The correct answer is E The provision w... View full answer

Get step-by-step solutions from verified subject matter experts