Question: Assume that Four Company uses backflush costing with two trigger points: the purchase of raw materials and the sale of goods. The journal entry to

Assume that Four Company uses backflush costing with two trigger points: the purchase of raw materials and the sale of goods.

The journal entry to record the purchase of raw materials would include

| No entry would be required | ||||||||||||||||||||||||||||||||||||||

| A debit to cost of goods sold for $250,000 | ||||||||||||||||||||||||||||||||||||||

| A debit to finished goods inventory for $250,000 | ||||||||||||||||||||||||||||||||||||||

| A debit to raw materials and in-process inventory for $250,000 Assume that Four Company uses backflush costing with two trigger points: the purchase of raw materials and the sale of goods. The journal entry to record the direct labor cost incurred would include

The journal entry to record the completion of the goods would include

|

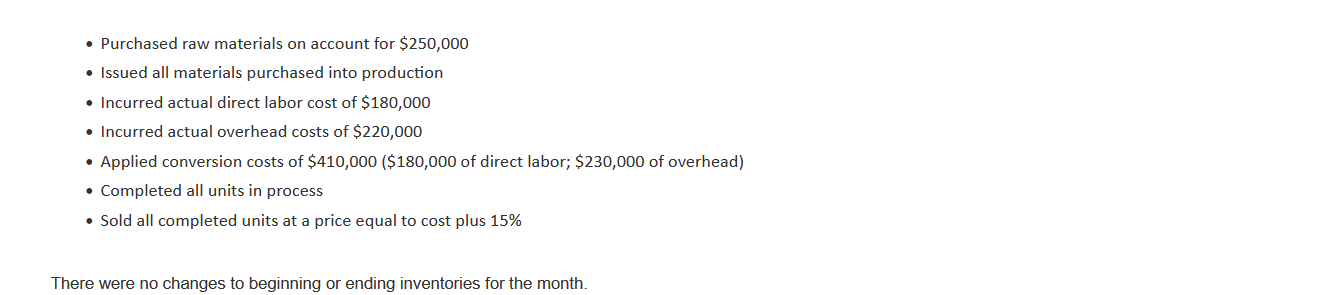

- Purchased raw materials on account for $250,000 - Issued all materials purchased into production - Incurred actual direct labor cost of $180,000 - Incurred actual overhead costs of $220,000 - Applied conversion costs of $410,000 (\$180,000 of direct labor; $230,000 of overhead) - Completed all units in process - Sold all completed units at a price equal to cost plus 15% There were no changes to beginning or ending inventories for the month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts