Question: Assume that Test Company uses backflush costing with two trigger points: the purchase of raw materials and the sale of goods. The journal entry to

Assume that Test Company uses backflush costing with two trigger points: the purchase of raw materials and the sale of goods. The journal entry to record the issue of direct materials to production would include

| No entry would be required | ||||||||||||||||||||||||||

| A debit to finished goods inventory for $200,000 | ||||||||||||||||||||||||||

| A debit to raw materials and in-process inventory for $200,000 | ||||||||||||||||||||||||||

| A debit to cost of goods sold for $200,000 Assume that Test Company uses backflush costing with one trigger point: the sale of goods. The journal entry to record the sale of goods would include

Assume that Test Company uses backflush costing with one trigger point: the completion of goods. The journal entry to record the completion of the goods would include

|

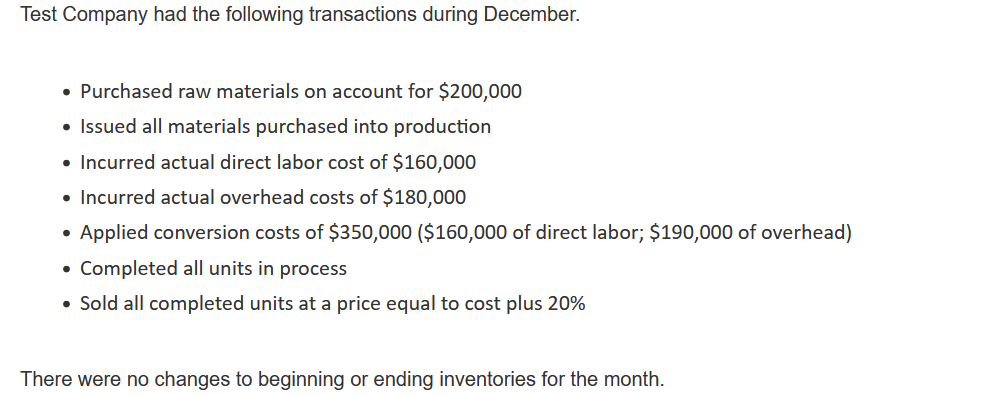

Test Company had the following transactions during December. - Purchased raw materials on account for $200,000 - Issued all materials purchased into production - Incurred actual direct labor cost of \$160,000 - Incurred actual overhead costs of $180,000 - Applied conversion costs of $350,000 (\$160,000 of direct labor; $190,000 of overhead) - Completed all units in process - Sold all completed units at a price equal to cost plus 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts