Question: Assume that in the original Ityesi example in Table below, all sales actually occur in the United States and are projected to be $61.5 million

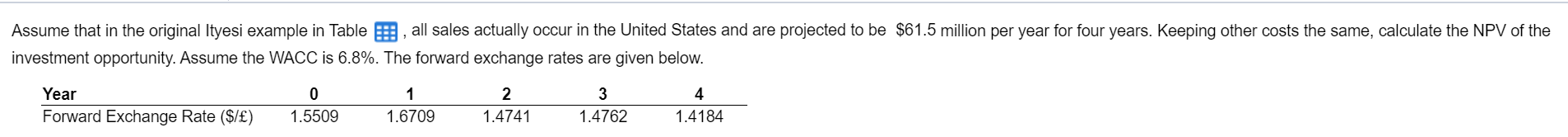

Assume that in the original Ityesi example in Table below, all sales actually occur in the United States and are projected to be $61.5 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity. Assume the WACC is 6.8%. The forward exchange rates are given below.

| Year | 0 | 1 | 2 | 3 | 4 |

| Forward Exchange Rate ($/pound) | 1.5509 | 1.6709 | 1.4741 | 1.4762 | 1.4184 |

(Round to three decimal places. Forward exchange rates must be rounded to four decimal places.)

(Round to three decimal places. Forward exchange rates must be rounded to four decimal places.)

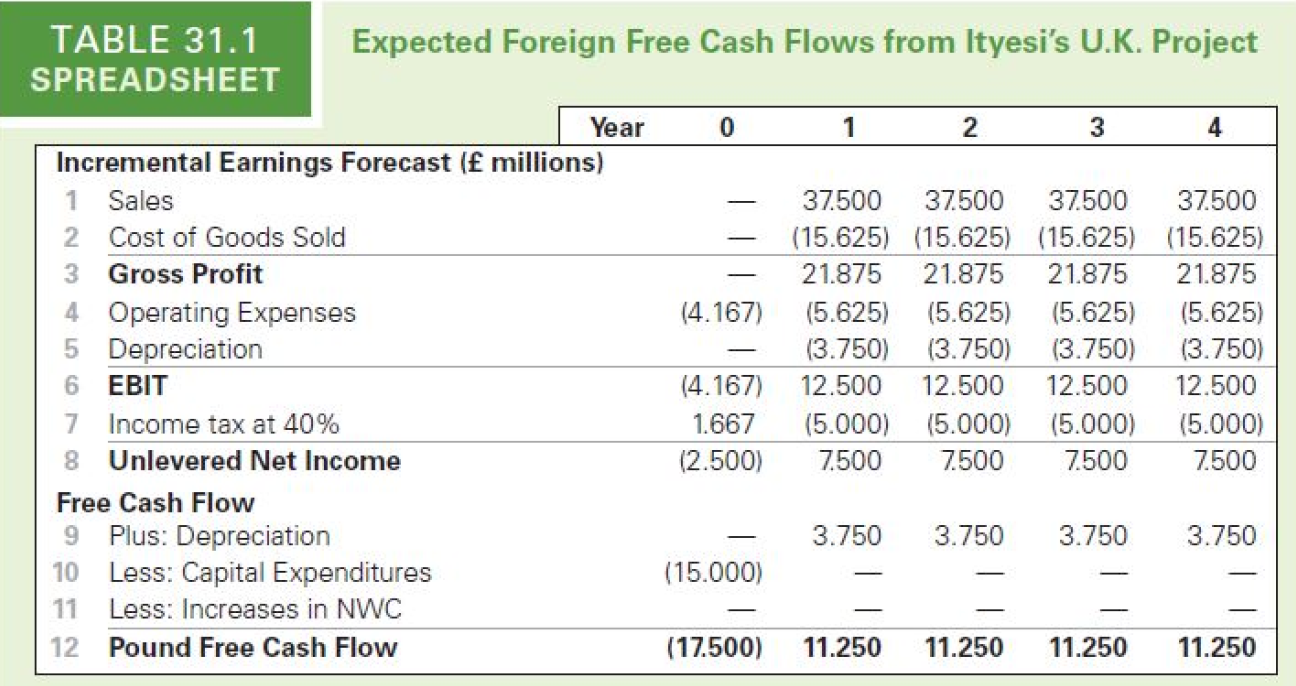

ano una sana na serie de ses sin interesan kes the case to me urvaren Assume that in the original Ityesi example in Table , all sales actually occur in the United States and are projected to be $61.5 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity. Assume the WACC is 6.8%. The forward exchange rates are given below. Year 0 1 2 3 Forward Exchange Rate ($/) 1.5509 1.6709 1.4741 1.4762 1.4184 - TABLE 31.1 Expected Foreign Free Cash Flows from Ityesi's U.K. Project SPREADSHEET Year 0 1 2 3 4 Incremental Earnings Forecast (f millions) 1 Sales 37.500 37.500 37.500 37.500 2 Cost of Goods Sold (15.625) (15.625) (15.625) (15.625) 3 Gross Profit 21.875 21.875 21.875 21.875 4 Operating Expenses (4.167) (5.625) (5.625) (5.625) (5.625) 5 Depreciation (3.750) (3.750) (3.750) (3.750) 6 EBIT (4.167) 12.500 12.500 12.500 12.500 7 Income tax at 40% 1.667 (5.000) (5.000) (5.000) (5.000) 8 Unlevered Net Income (2.500) 7.500 7.500 7.500 7500 Free Cash Flow 9 Plus: Depreciation - 3.750 3.750 3.750 3.750 10 Less: Capital Expenditures (15.000) - - - 11 Less: Increases in NWC 12 Pound Free Cash Flow (17.500) 11.250 11.250 11.250 11.250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts