Question: Assume that in the original Ityesi example in Table LOADING..., all sales actually occur in the United States and are projected to be$ 64.3 million

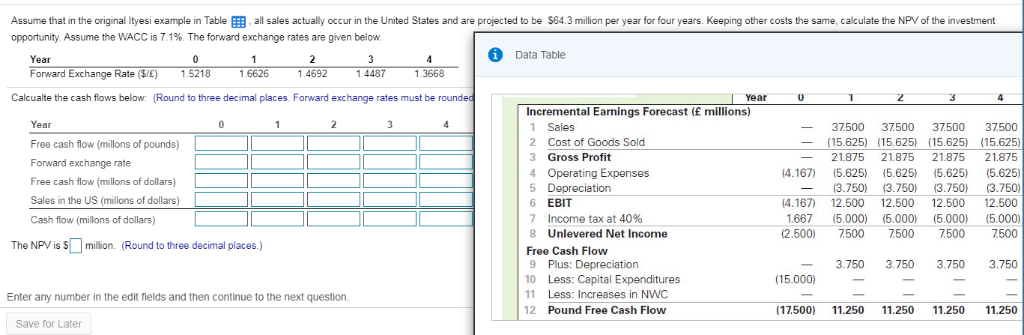

Assume that in the original Ityesi example in Table LOADING..., all sales actually occur in the United States and are projected to be$ 64.3 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity. Assume the WACC is 7.1 %. The forward exchange rates are given below.

Assume that in the original Ityesi example in Table LOADING..., all sales actually occur in the United States and are projected to be$ 64.3 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity. Assume the WACC is 7.1 %. The forward exchange rates are given below.

Assume that in the original Ityesi example in Table all sales actually occur in the United States and are projected to be $64.3 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity Assume the WACC is 71% The forward exchange rates are given below Data Table Year Forward Exchange Rate (S/E) 1.52186626 1.4692 14487 13668 Calcualte the cash flows below: (Round to three decimal places. Forward exchange rates must be r Year 2 3 Incremental Earnings Forecast (E millions) 1 Sales 2 Cost of Goods Solod 3 Gross Profit 4 Operating Expenses 5 Depreciation 6 EBIT 7 Income tax at 40% 8 Unlevered Net Income Free Cash Flow 9 Plus: Depreciation 10 Less: Capital Expenditures 11 Less: Increases in NWC Year Free cash flow (millons of pounds) Forward exchange rate Free cash flow (millons of dollars) Sales in the US (millons of dollars) Cash flow (millons of dollars) 37500 37500 37500 37500 -(15.625) 15.625) 15.625) 15.625) 21.875 21.875 21.875 21.875 4.167) 5.625 5.625 5.625) (5.625) (3.750 (3.750) 43.750) (3.750) 4.167) 12.500 2.500 2.500 12.500 1.667 15.000) (5.000} (5.000) {5.000) (2.500 7500 7500 7500 7500 The NPV is Smllion (Round to three decimal places.) 3.750 3.750 3.750 3.750 (15.000) Enter any number in the edit fields and then continue to the next question. 12 Pound Free Cash Flow 17500 11.250 11.250 11.250 11.250 Save for Later Assume that in the original Ityesi example in Table all sales actually occur in the United States and are projected to be $64.3 million per year for four years. Keeping other costs the same, calculate the NPV of the investment opportunity Assume the WACC is 71% The forward exchange rates are given below Data Table Year Forward Exchange Rate (S/E) 1.52186626 1.4692 14487 13668 Calcualte the cash flows below: (Round to three decimal places. Forward exchange rates must be r Year 2 3 Incremental Earnings Forecast (E millions) 1 Sales 2 Cost of Goods Solod 3 Gross Profit 4 Operating Expenses 5 Depreciation 6 EBIT 7 Income tax at 40% 8 Unlevered Net Income Free Cash Flow 9 Plus: Depreciation 10 Less: Capital Expenditures 11 Less: Increases in NWC Year Free cash flow (millons of pounds) Forward exchange rate Free cash flow (millons of dollars) Sales in the US (millons of dollars) Cash flow (millons of dollars) 37500 37500 37500 37500 -(15.625) 15.625) 15.625) 15.625) 21.875 21.875 21.875 21.875 4.167) 5.625 5.625 5.625) (5.625) (3.750 (3.750) 43.750) (3.750) 4.167) 12.500 2.500 2.500 12.500 1.667 15.000) (5.000} (5.000) {5.000) (2.500 7500 7500 7500 7500 The NPV is Smllion (Round to three decimal places.) 3.750 3.750 3.750 3.750 (15.000) Enter any number in the edit fields and then continue to the next question. 12 Pound Free Cash Flow 17500 11.250 11.250 11.250 11.250 Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts