Question: Assume that P/E ratios are computed using current price and expected earnings (rather than current earnings), and that all earnings and dividend values are annual

Assume that P/E ratios are computed using current price and expected earnings (rather than current earnings), and that all earnings and dividend values are annual values. (SHOW ALL CALCULATIONS, NO EXCEL FUNCTIONS)

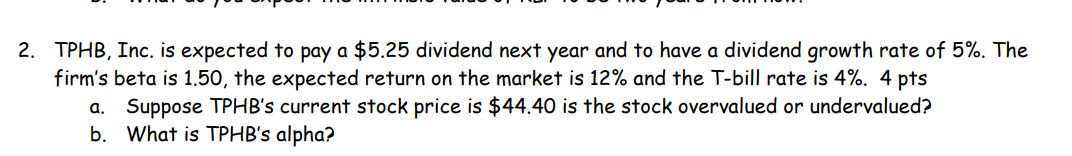

2. TPHB, Inc. is expected to pay a $5.25 dividend next year and to have a dividend growth rate of 5%. The firm's beta is 1.50, the expected return on the market is 12% and the T-bill rate is 4%. 4 pts a. Suppose TPHB's current stock price is $44.40 is the stock overvalued or undervalued? b. What is TPHB's alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts