Question: Assume that P/E ratios are computed using current price and expected earnings (rather than current earnings), and that all earnings and dividend values are annual

Assume that P/E ratios are computed using current price and expected earnings (rather than current earnings), and that all earnings and dividend values are annual values. (SHOW ALL CALCULATIONS, NO EXCEL FUNCTIONS)

Assume that P/E ratios are computed using current price and expected earnings (rather than current earnings), and that all earnings and dividend values are annual values. (SHOW ALL CALCULATIONS, NO EXCEL FUNCTIONS)

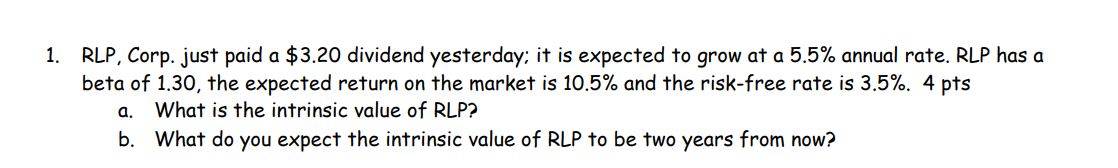

1. RLP, Corp. just paid a $3.20 dividend yesterday; it is expected to grow at a 5.5% annual rate. RLP has a beta of 1.30, the expected return on the market is 10.5% and the risk-free rate is 3.5%. 4 pts a. What is the intrinsic value of RLP? b. What do you expect the intrinsic value of RLP to be two years from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts