Question: Assume that security returns are generated by the single-index model, R1=a1+1R2+1 Where R1 is the excess return for security / and RM is the market's

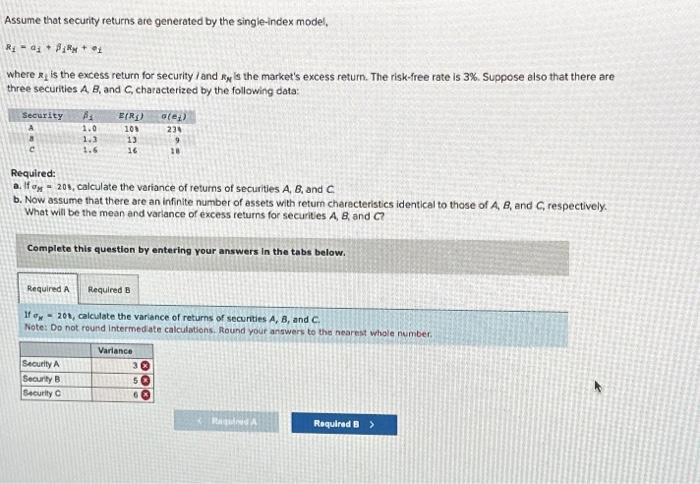

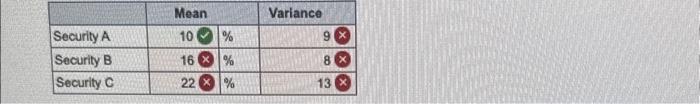

Assume that security returns are generated by the single-index model, R1=a1+1R2+1 Where R1 is the excess return for security / and RM is the market's excess return. The risk-free rate is 3%. Suppose also that there are three securities A,B, and C, characterized by the following data: Required: a. If M=20, calculate the variance of returns of securities A,B, and C b. Now assume that there are an infinite number of assets with retum charecteristics identical to those of A,B, and C, respectively. What will be the mean and varlance of excess returns for securities A,B, and C ? Complete this question by entering your answers in the tabs below. If K=202, calculate the variance of returns of securities A,B, and C Note: Do not round intermedate calculations. Round your answers to the nearnst whole number. 8:8=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts