Question: Assume that the initial margin is 5 0 % . The investor pays 4 , 0 0 0 to purchase 1 , 0 0 0

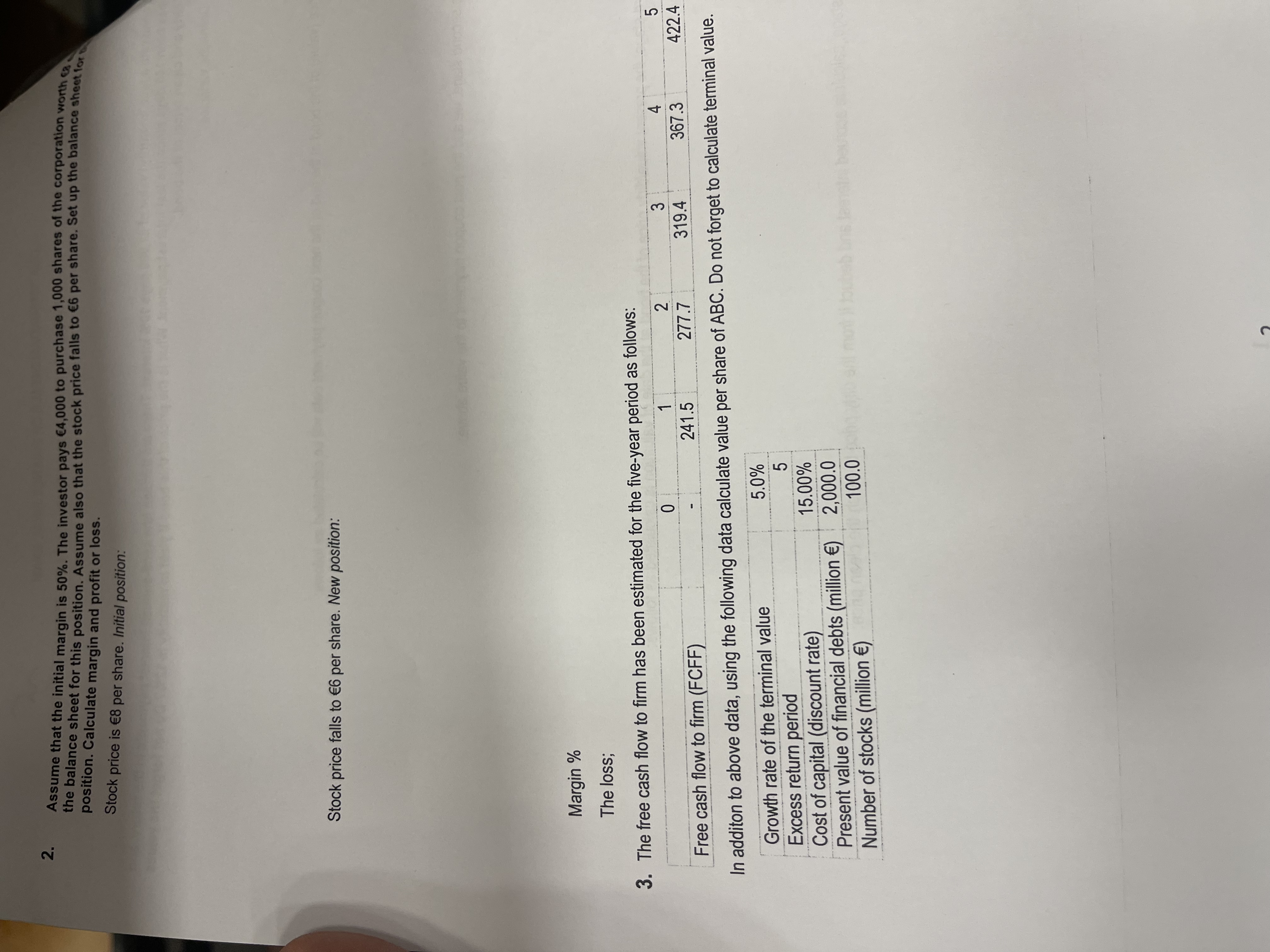

Assume that the initial margin is The investor pays to purchase shares of the corporation worth the balance sheet for this position. Assume also that the stock price falls to per share. Set up the balance sheet for position. Calculate margin and profit or loss.

Stock price is per share. Initial position:

Stock price falls to per share. New position:

Margin

The loss;

The free cash flow to firm has been estimated for the fiveyear period as follows:

tableFree cash flow to firm FCFF

In additon to above data, using the following data calculate value per share of ABC. Do not forget to calculate terminal value.

tableGrowth rate of the terminal value,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock