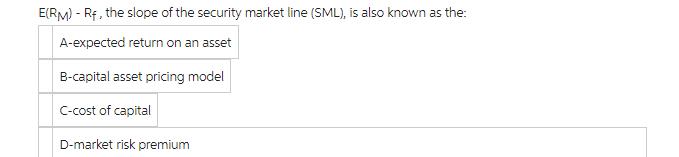

Question: E(RM) - Rf, the slope of the security market line (SML), is also known as the: A-expected return on an asset B-capital asset pricing

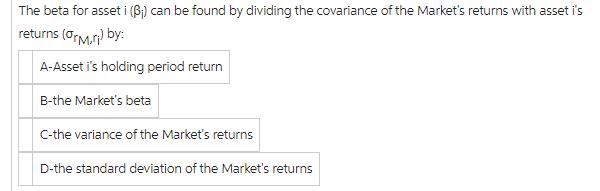

E(RM) - Rf, the slope of the security market line (SML), is also known as the: A-expected return on an asset B-capital asset pricing model C-cost of capital D-market risk premium The beta for asset i (B) can be found by dividing the covariance of the Market's returns with asset i's returns (Orm.r) by: A-Asset i's holding period return B-the Market's beta C-the variance of the Market's returns D-the standard deviation of the Market's returns

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER C Cost of capital Cost of capital is the minimum rate of return or profit a company must earn ... View full answer

Get step-by-step solutions from verified subject matter experts