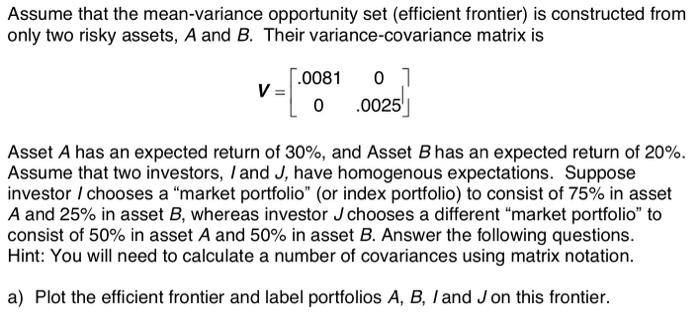

Question: Assume that the mean-variance opportunity set (efficient frontier) is constructed from only two risky assets, A and B. Their variance-covariance matrix is V=[.008100.0025] Asset A

Assume that the mean-variance opportunity set (efficient frontier) is constructed from only two risky assets, A and B. Their variance-covariance matrix is V=[.008100.0025] Asset A has an expected return of 30%, and Asset B has an expected return of 20%. Assume that two investors, I and J, have homogenous expectations. Suppose investor / chooses a "market portfolio" (or index portfolio) to consist of 75% in asset A and 25% in asset B, whereas investor J chooses a different "market portfolio" to consist of 50% in asset A and 50% in asset B. Answer the following questions. Hint: You will need to calculate a number of covariances using matrix notation. a) Plot the efficient frontier and label portfolios A,B,I and J on this frontier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts