Question: Assume that the total sales value at the split - off point for product 1 is $ 8 1 , 0 0 0 instead of

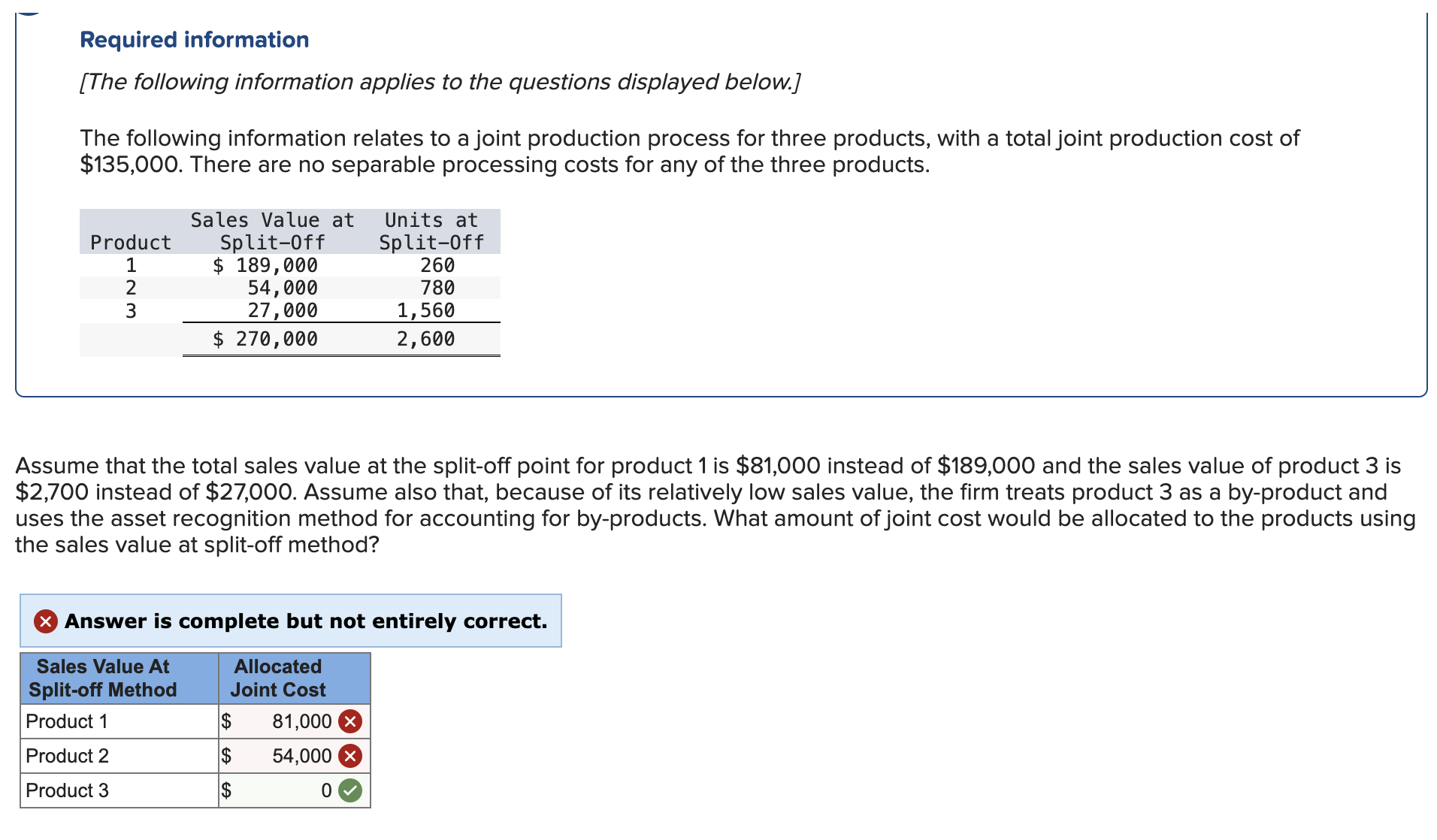

Assume that the total sales value at the splitoff point for product is $ instead of $ and the sales value of product is $ instead of $ Assume also that, because of its relatively low sales value, the firm treats product as a byproduct and uses the asset recognition method for accounting for byproducts. What amount of joint cost would be allocated to the products using the sales value at splitoff method? Required information

The following information applies to the questions displayed below.

The following information relates to a joint production process for three products, with a total joint production cost of $ There are no separable processing costs for any of the three products.

Assume that the total sales value at the splitoff point for product is $ instead of $ and the sales value of product is $ instead of $ Assume also that, because of its relatively low sales value, the firm treats product as a byproduct and uses the asset recognition method for accounting for byproducts. What amount of joint cost would be allocated to the products using the sales value at splitoff method?

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock