Question: Assume that you are using the dividend discount model (the Gordon model) to value stock the stock currently pays no dividends but expected to

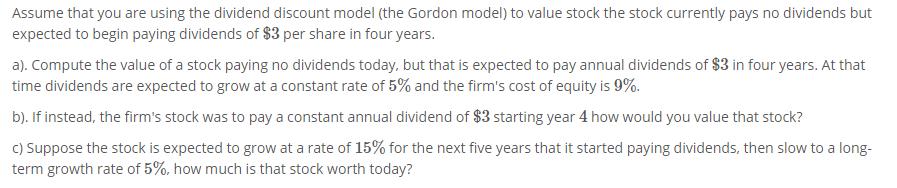

Assume that you are using the dividend discount model (the Gordon model) to value stock the stock currently pays no dividends but expected to begin paying dividends of $3 per share in four years. a). Compute the value of a stock paying no dividends today, but that is expected to pay annual dividends of $3 in four years. At that time dividends are expected to grow at a constant rate of 5% and the firm's cost of equity is 9%. b). If instead, the firm's stock was to pay a constant annual dividend of $3 starting year 4 how would you value that stock? C) Suppose the stock is expected to grow at a rate of 15% for the next five years that it started paying dividends, then slow to a long- term growth rate of 5%, how much is that stock worth today?

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Value of Stock is given byD01gKg Where g is growth rate and K is cost of equity a V... View full answer

Get step-by-step solutions from verified subject matter experts