Question: Assume that you can tolerate a 0.03 STD risk. Initialize the portfolio weight to equal weights before applying the solver. Provide the weights of begin{tabular}{l|l|l|l|l}

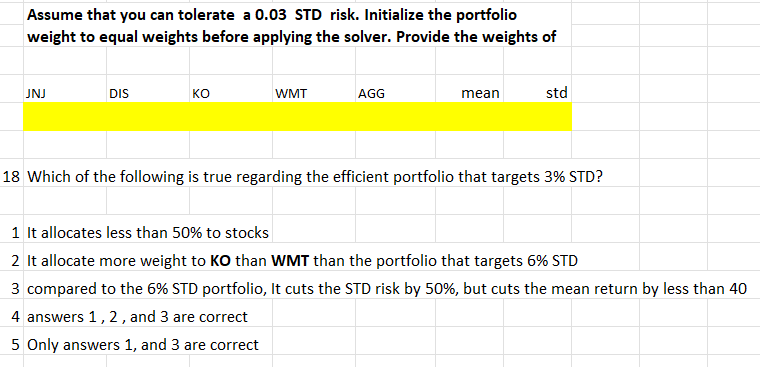

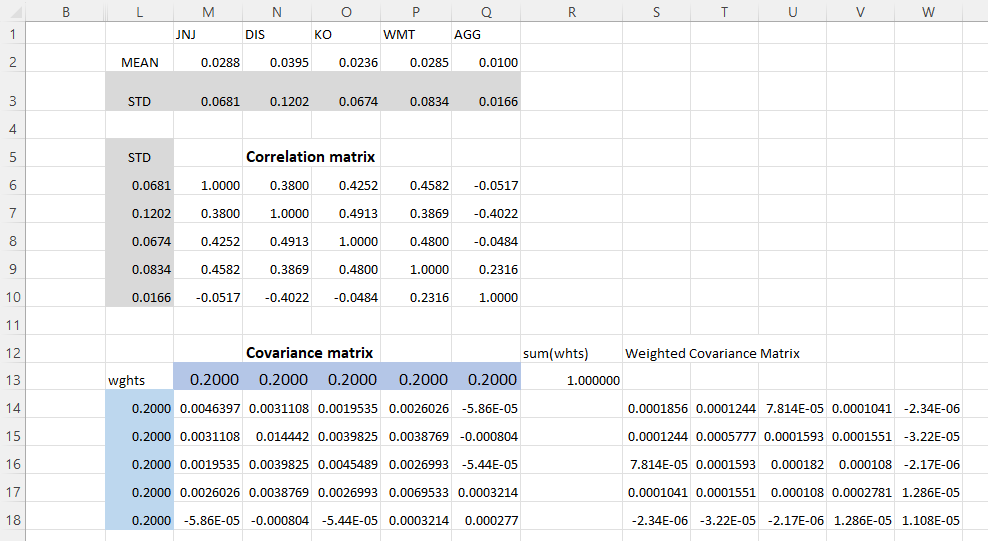

Assume that you can tolerate a 0.03 STD risk. Initialize the portfolio weight to equal weights before applying the solver. Provide the weights of \begin{tabular}{l|l|l|l|l} JNJ DIS & KO \end{tabular} 18 Which of the following is true regarding the efficient portfolio that targets 3\% STD? 1 It allocates less than 50% to stocks 2 It allocate more weight to KO than WMT than the portfolio that targets 6\% STD 3 compared to the 6% STD portfolio, It cuts the STD risk by 50%, but cuts the mean return by less than 40 4 answers 1,2 , and 3 are correct 5 Only answers 1 , and 3 are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts