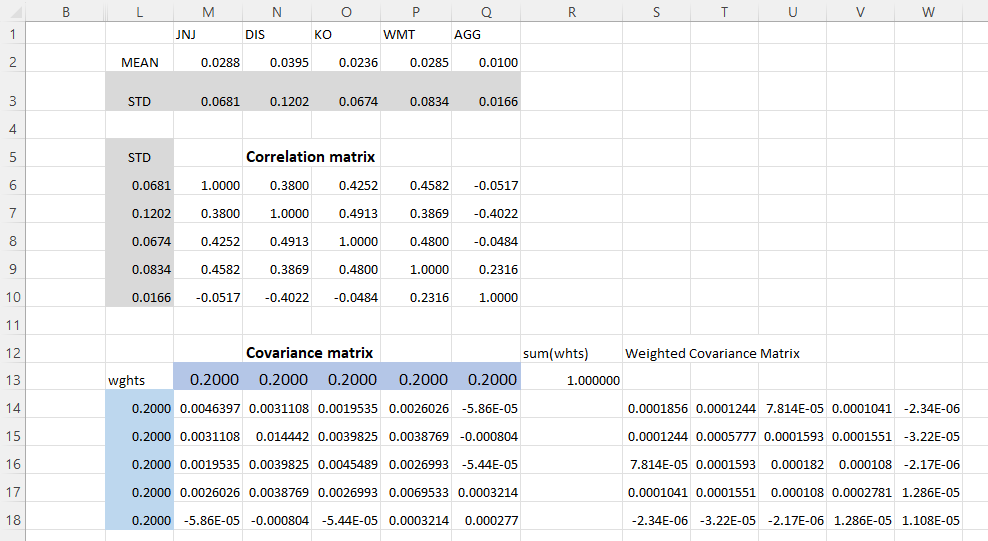

Question: Assume that you can tolerate a 0.06 STD risk. Initialize the solver with equal-weights portfolio in M13:Q13, solve for the weights that maximizes the mean

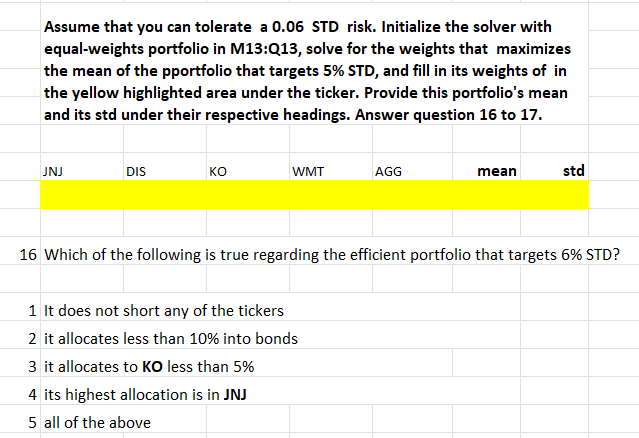

Assume that you can tolerate a 0.06 STD risk. Initialize the solver with equal-weights portfolio in M13:Q13, solve for the weights that maximizes the mean of the pportfolio that targets 5\% STD, and fill in its weights of in the yellow highlighted area under the ticker. Provide this portfolio's mean and its std under their respective headings. Answer question 16 to 17. \begin{tabular}{|l|l|l|l|l|l|} \hline JNJ KO & WIS & WMT & AGG & mean \end{tabular} 16 Which of the following is true regarding the efficient portfolio that targets 6% STD? 1 It does not short any of the tickers 2 it allocates less than 10% into bonds 3 it allocates to KO less than 5% 4 its highest allocation is in JNJ 5 all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts