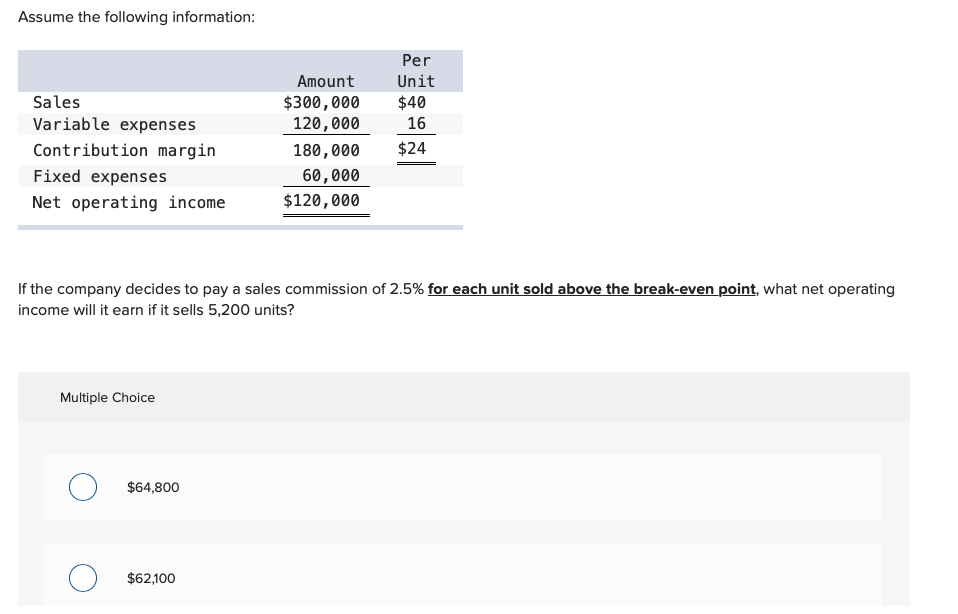

Question: Assume the following information: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $300,000 120,000 180,000 60,000 $120,000 Per Unit $40 16 $24

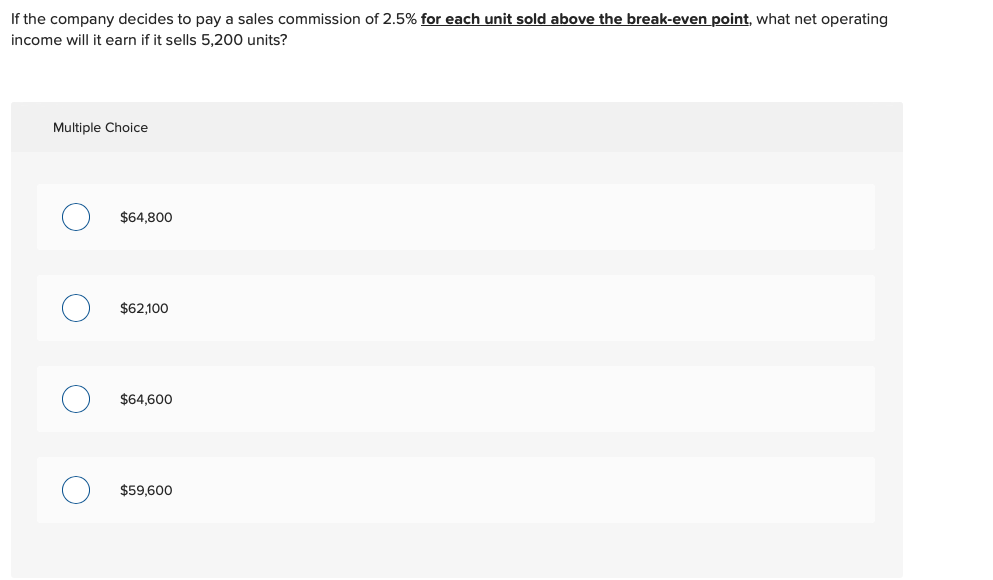

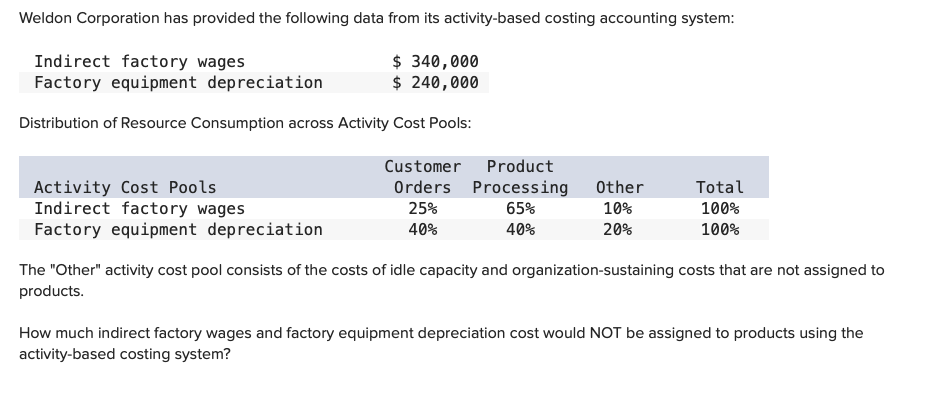

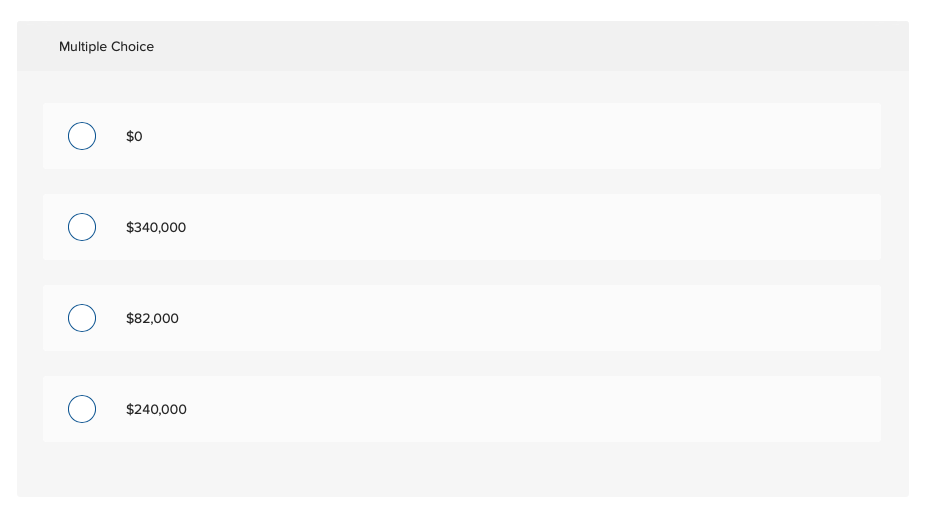

Assume the following information: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $300,000 120,000 180,000 60,000 $120,000 Per Unit $40 16 $24 If the company decides to pay a sales commission of 2.5% for each unit sold above the break-even point, what net operating income will it earn if it sells 5,200 units? Multiple Choice $64,800 $62,100 If the company decides to pay a sales commission of 2.5% for each unit sold above the break-even point, what net operating income will it earn if it sells 5,200 units? Multiple Choice $64,800 $62,100 $64,600 O $59,600 Weldon Corporation has provided the following data from its activity-based costing accounting system: Indirect factory wages Factory equipment depreciation $ 340,000 $ 240,000 Distribution of Resource Consumption across Activity Cost Pools: Activity Cost Pools Indirect factory wages Factory equipment depreciation Customer Product Orders Processing 25% 65% 40% 40% Other 10% 20% Total 100% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system? Multiple Choice $0 $340,000 $82,000 $240,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts