Question: Assume the same facts as in part (a) except that BO purchased the equipment on September 30 rather than on June 1. Also assume that

Assume the same facts as in part (a) except that BO purchased the equipment on September 30 rather than on June 1. Also assume that BO ended up selling the piece of equipment on June 30, 2026, for $19,780. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

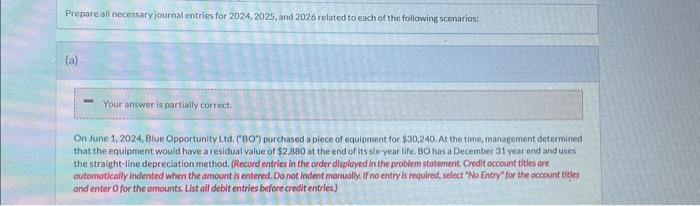

Prepare all necessary journal entries for 2024,2025, and 2026 related to each of the following scenarios: (a) On June 1,2024, Blue Opportunity Ltd. ("BO") purchased a piece of equipment for $30,240. At the time, management determined that the equipment would have a residual value of $2.850 at the end of its sbcyear life. BO has a December 31 year end and uses the straight-line depreciution method. (Record entries in the order disployed in the problem statement. Credit occount dites dre automatically indented when the amount is entered. Do not indent nianuali. If no entry is required, select "No Entry" for the occount Hities and enter o for the amounts. List all debit entries before credit entries) Prepare all necessary journal entries for 2024,2025, and 2026 related to each of the following scenarios: (a) On June 1,2024, Blue Opportunity Ltd. ("BO") purchased a piece of equipment for $30,240. At the time, management determined that the equipment would have a residual value of $2.850 at the end of its sbcyear life. BO has a December 31 year end and uses the straight-line depreciution method. (Record entries in the order disployed in the problem statement. Credit occount dites dre automatically indented when the amount is entered. Do not indent nianuali. If no entry is required, select "No Entry" for the occount Hities and enter o for the amounts. List all debit entries before credit entries)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts