Question: Assume the same facts as in problem 4. Assume that the $60,000 ending inventory is sold by Ramos by the end of 2011. Also assume

Assume the same facts as in problem 4. Assume that the $60,000 ending inventory is sold by Ramos by the end of 2011. Also assume that in 2011, Tolson purchases an additional $80,000 in inventory from third parties and sells it to Ramos for $100,000. At the end of 2011, $40,000 of this inventory is unsold. In 2011, Tolson earns $500,000 and pays dividends of $400,000. Ramos earns $200,000 and pays dividends of $80,000. What is the amount of equity income recorded by Tolson in 2011?

Data From Problem 4.

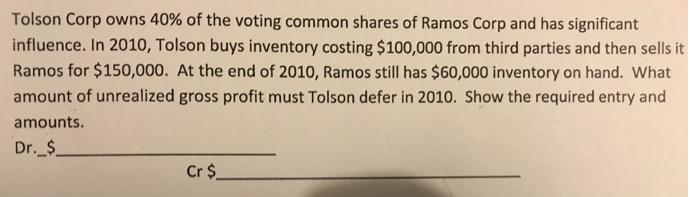

Tolson Corp owns 40% of the voting common shares of Ramos Corp and has significant influence. In 2010, Tolson buys inventory costing $100,000 from third parties and then sells it Ramos for $150,000. At the end of 2010, Ramos still has $60,000 inventory on hand. What amount of unrealized gross profit must Tolson defer in 2010. Show the required entry and amounts. Dr. $ Cr $

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

To calculate the equity income recorded by Tolson in 2011 follow these steps Step 1 Calculate Tolson... View full answer

Get step-by-step solutions from verified subject matter experts