Question: Assume the same situation as in #4 (see question #4 below for reference on the situation), except that these bonds had been swapped for common

Assume the same situation as in #4 (see question #4 below for reference on the situation), except that these bonds had been swapped for common stock at NBV. Recalculate the ratio in #1, assuming conventional GAAP (i.e., not corrected for the equity value of the instrument).

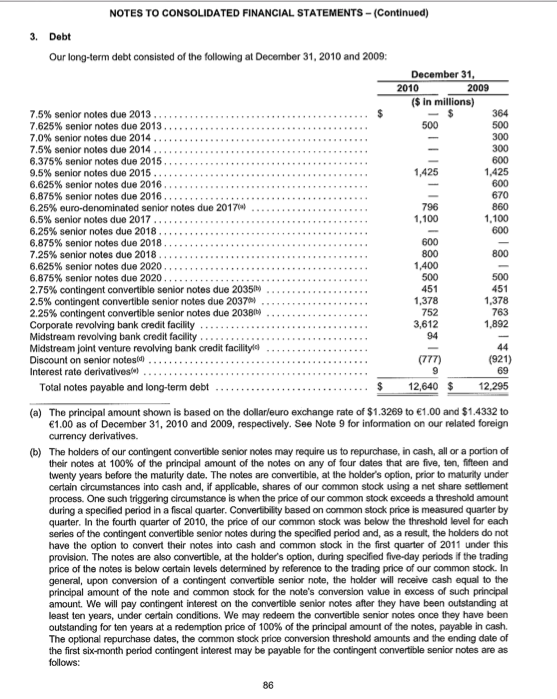

Assume that these bonds (See the 2.25% contingent convertible notes due 2037 - row 18 in footnote 3) have been repurchased at par right before year-end 2010. Recalculate the ratio in #1 (ratio is long term debt / total equity = .83), assuming conventional GAAP (i.e. not corrected for the equity value of the instrument). Assume that the year-end interest payment had already been made.

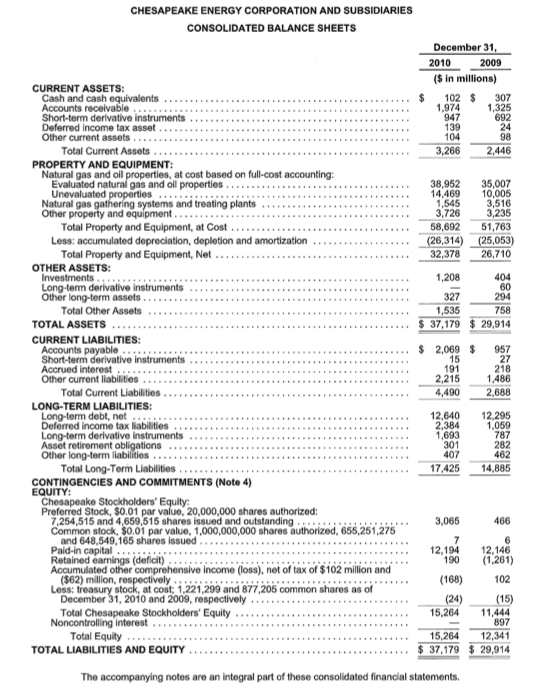

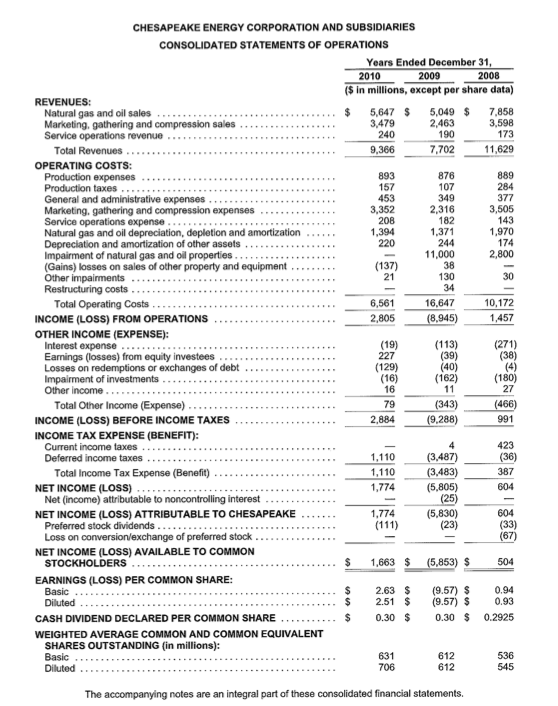

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, 2010 2009 ($ in millions) CURRENT ASSETS: Cash and cash equivalents . .. . . . $ 102 307 Accounts receivable .... . . . .... 1.974 1,325 Short-term derivative instruments 947 692 Deferred income tax asset . . 139 24 Other current assets . 104 98 Total Current Assets . . 3,266 2,446 PROPERTY AND EQUIPMENT: Natural gas and oil properties, at cost based on full-cost accounting: Evaluated natural gas and oil properties...... ........ . . ..... . . . ...1 1 1 18 38,952 35,007 Unevaluated properties............. . .. 14,469 10,005 Natural gas gathering systems and treating plants 1.545 3.516 Other property and equipment.................... 3,726 3,235 Total Property and Equipment, at Cost . 58,692 51,763 Less: accumulated depreciation, depletion and amortization (26,314) (25,053) Total Property and Equipment, Net . . . . . . .. 32,378 26,710 OTHER ASSETS: Investments....... .............. 1,208 404 Long-term derivative instruments 60 Other long-term assets . .. 327 294 Total Other Assets 1,535 758 TOTAL ASSETS ...... $ 37,179 $ 29.914 CURRENT LIABILITIES: Accounts payable ....... . . . ... $ 2.069 $ 757 Short-term derivative instruments 15 Accrued interest 191 218 Other current liabilities . . . . . . . . 2,215 1,486 Total Current Liabilities . . . . . . . 4,490 2,688 LONG-TERM LIABILITIES: Long-term debt, net.........seats 12,640 12.295 Deferred income tax liabilities . . . . 2.384 1.059 Long-term derivative instruments 1.693 787 Asset retirement obligations .. .. .. . 301 282 Other long-term liabilities..... .. . . . . . . .. 407 462 Total Long-Term Liabilities . . . . . . 17,425 14.885 CONTINGENCIES AND COMMITMENTS (Note 4) EQUITY: Chesapeake Stockholders' Equity: Preferred Stock, $0.01 par value, 20,000,000 shares authorized: 7,254,515 and 4,659,515 shares issued and outstanding..... .......... ... 3.065 466 Common stock, $0.01 par value, 1,000,000,000 shares authorized, 655,251,275 and 648,549,165 shares issued . . . Paid-in capital path 12.194 12.146 Retained earnings (deficit) . . . .. . 190 (1,261) Accumulated other comprehensive income (loss), not of tax of $102 million and ($62) million, respectively .; (168) 102 Less: treasury stock, at cost; 1,221,299 and 877,205 common shares as of December 31, 2010 and 2009, respectively . . . . . . (24) (15) Total Chesapeake Stockholders' Equity............ ....... 15,264 11,444 Noncontrolling interest . . . . .. . ..... 897 Total Equity . . .. . . . 15,264 12,341 TOTAL LIABILITIES AND EQUITY ...... $ 37,179 $ 29,914 The accompanying notes are an integral part of these consolidated financial statements.CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31, 2010 2009 2008 ($ in millions, except per share data) REVENUES: Natural gas and oil sales ............ ..... 5,647 $ 5.049 $ 7.858 Marketing, gathering and compression sales 3.479 2,463 3.598 Service operations revenue ... ... .. 240 190 173 Total Revenues 9.366 7,702 11,629 OPERATING COSTS: Production expenses 893 876 889 Production taxes ... . . . . 157 107 284 General and administrative expenses ......... .: 453 349 377 Marketing, gathering and compression expenses 3,352 2,316 3,505 Service operations expense..........18... 208 182 143 Natural gas and oil depreciation, depletion and amortization . . . . . 1.394 1,371 1,970 Depreciation and amortization of other assets . .. ... .. . . . . . . . . . 220 244 174 Impairment of natural gas and oil properties. . . . . . .. . . . . . . . . . . . . 11,000 2,800 (Gains) losses on sales of other property and equipment . (137) 38 Other impairments 21 130 30 Restructuring costs 34 Total Operating Costs . .. 6,561 16.647 10.172 INCOME (LOSS) FROM OPERATIONS 2,805 (8.945 1,457 OTHER INCOME (EXPENSE): (19) (113) (271) Earnings (losses) from equity investees ..... ...... 227 (39) (38) Losses on redemptions or exchanges of debt (129) (40) (4) Impairment of investments . . (16) (162) (180) Other income . . . . 16 11 27 Total Other Income (Expense) ... .. .. . . . . .. 79 (343) (466) INCOME (LOSS) BEFORE INCOME TAXES 2.884 (9.288) 991 INCOME TAX EXPENSE (BENEFIT): Current income taxes . .. . . . . . . 423 Deferred income taxes . . . 1,110 (3,487) (36) Total Income Tax Expense (Benefit) .... 1,110 (3,483) 387 NET INCOME (LOSS) .... . . . . . 1,774 (5,805) 604 Net (income) attributable to noncontrolling interest . . . . . . . . (25) NET INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE 1,774 (5,830) 604 Preferred stock dividends . . . . . . . (111) (23) (33) Loss on conversion/exchange of preferred stock . (67] NET INCOME (LOSS) AVAILABLE TO COMMON STOCKHOLDERS . S 1.663 $ (5,853) $ 504 EARNINGS (LOSS) PER COMMON SHARE: Basic . .... 2.63 $ (9.57) $ 0.94 Diluted . 2.51 (9.57) s 0.93 CASH DIVIDEND DECLARED PER COMMON SHARE S 0.30 $ 0.30 0.2925 WEIGHTED AVERAGE COMMON AND COMMON EQUIVALENT SHARES OUTSTANDING (in millions): Basic . . . .. 631 612 536 Diluted . . . 706 612 545 The accompanying notes are an integral part of these consolidated financial statements.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 3. Debt Our long-term debt consisted of the following at December 31, 2010 and 2009: December 31, 2010 2009 ($ in millions 7.5% senior notes due 2013 . . . . . . . . . . $ 364 7.625% senior notes due 2013. 500 500 7.0% senior notes due 2014 . . . . . . . .. 300 7.5% senior notes due 2014 . . . . . . . . . 300 6.375% senior notes due 2015 600 9.5% senior notes due 2015 . . . . . . . . . . 1,425 1.425 6.625% senior notes due 2016. . . . . . . . 600 6.875% senior notes due 2016. . . . . . . . . 670 6.25% euro-denominated senior notes due 2017.......... .. .8141 796 860 6.5% senior notes due 2017 . . . . . . . . . 1,100 1,100 6.25% senior notes due 2018 . . . . . . . . . . 600 6.875% senior notes due 2018. 600 7.25% senior notes due 2018 . . . . . . . . . BOO 800 5.625% senior notes due 2020. . . . . . . . 1,400 6.875% senior notes due 2020 . . . . . . . . 500 500 2.75% contingent convertible senior notes due 2035) 451 451 2.5% contingent convertible senior notes due 2037%) 1,378 1,378 2.25% contingent convertible senior notes due 203Bit. 752 763 Corporate revolving bank credit facility . . . . . . 3,612 1,892 Midstream revolving bank credit facility . .. . . . ......... . ...... 94 Midstream joint venture revolving bank credit facilityis 44 Discount on senior notes!) . . . . . . . . . . . (777) (921) Interest rate derivatives .... . . .. ... 9 69 Total notes payable and long-term debt 12,640 $ 12,295 (a) The principal amount shown is based on the dollar/euro exchange rate of $1.3269 to (1.00 and $1.4332 to $1.00 as of December 31, 2010 and 2009, respectively. See Note 9 for information on our related foreign currency derivatives. (b) The holders of our contingent convertible senior notes may require us to repurchase, in cash, all or a portion of their notes at 100% of the principal amount of the notes on any of four dates that are five, ten, fifteen and twenty years before the maturity date. The notes are convertible, at the holder's option, prior to maturity under certain circumstances into cash and, if applicable, shares of our common stock using a net share settlement process. One such triggering circumstance is when the price of our common stock exceeds a threshold amount during a specified period in a fiscal quarter. Convertibility based on common stock price is measured quarter by quarter. In the fourth quarter of 2010, the price of our common stock was below the threshold level for each series of the contingent convertible senior notes during the specified period and, as a result, the holders do not have the option to convert their notes into cash and common stock in the first quarter of 2011 under this provision. The notes are also convertible, at the holder's option, during specified five-day periods if the trading price of the notes is below certain levels determined by reference to the trading price of our common stock. In general, upon conversion of a contingent convertible senior note, the holder will receive cash equal to the principal amount of the note and common stock for the note's conversion value in excess of such principal amount. We will pay contingent interest on the convertible senior notes after they have been outstanding at least ten years, under certain conditions. We may redeem the convertible senior notes once they have been outstanding for ten years at a redemption price of 100% of the principal amount of the notes, payable in cash. The optional repurchase dates, the common stock price conversion threshold amounts and the ending date of the first six-month period contingent interest may be payable for the contingent convertible senior notes are as follows: 86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts