Question: Assume there are initially only two assets in which to invest, A and B. Further assume no short- sale restrictions and that short-sale proceeds can

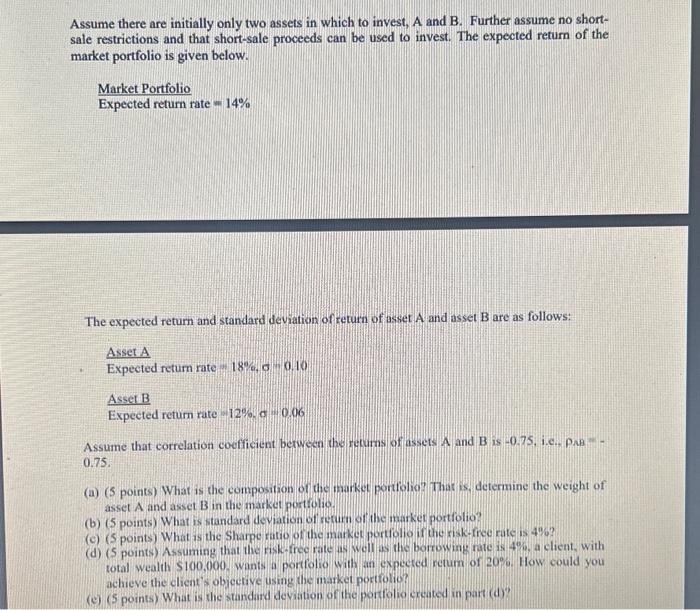

Assume there are initially only two assets in which to invest, A and B. Further assume no shortsale restrictions and that short-sale proceeds can be used to invest. The expected return of the market portfolio is given below. Market Portfolio Expected return rate =14% The expected return and standard deviation of return of asset A and asset B are as follows: Asset A Expected retum rate 18%,=0.10 Asset B Expected return rate 12%,=0.06 Assume that correlation coefficient berween the recurns of assets A and B is -0.75 , i.e., p.s = 0.75 . (a) (5 points) What is the composition of the market portiolio? That is, determine the weight of asset A and asset B in the market portolio. (b) (5 points) What is standard deviation of return of the market portfolio? (c) (s points) What is the Sharpe ratio of the market portfolio if the risk-free rate is 4\%? (d) (5 points) Assuming that the risk-free rate as Well as the borrowing nate is 4%, a client, with total wealth 5100,000 . wants a portiolio with an expected return of 20%. How could you achieve the client's objective using die market portiolio? (c) (5 points) What is the standard deviation of the porffolio created in part (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts