Question: Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $195.00. You purchase a 13 month European $9.00 strike call option on

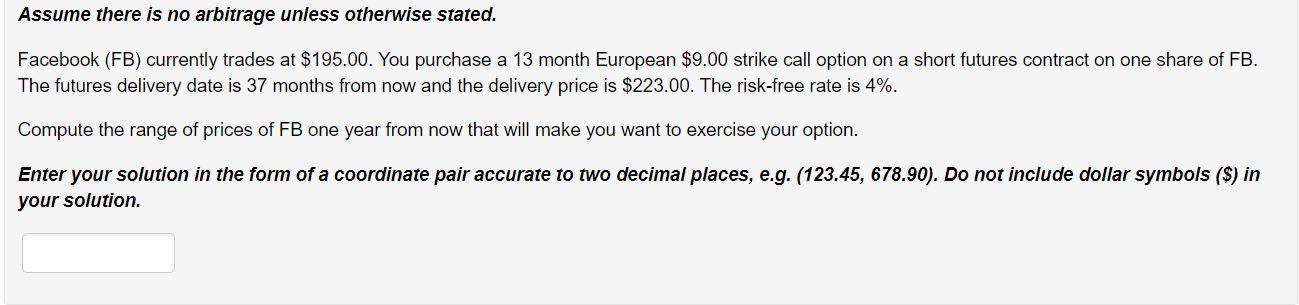

Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $195.00. You purchase a 13 month European $9.00 strike call option on a short futures contract on one share of FB. The futures delivery date is 37 months from now and the delivery price is $223.00. The risk-free rate is 4%. Compute the range of prices of FB one year from now that will make you want to exercise your option. Enter your solution in the form of a coordinate pair accurate to two decimal places, e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution. Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $195.00. You purchase a 13 month European $9.00 strike call option on a short futures contract on one share of FB. The futures delivery date is 37 months from now and the delivery price is $223.00. The risk-free rate is 4%. Compute the range of prices of FB one year from now that will make you want to exercise your option. Enter your solution in the form of a coordinate pair accurate to two decimal places, e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts