Question: Please mark out the answer for me. Thank you! (10 points) Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $202.00.

Please mark out the answer for me. Thank you!

Please mark out the answer for me. Thank you!

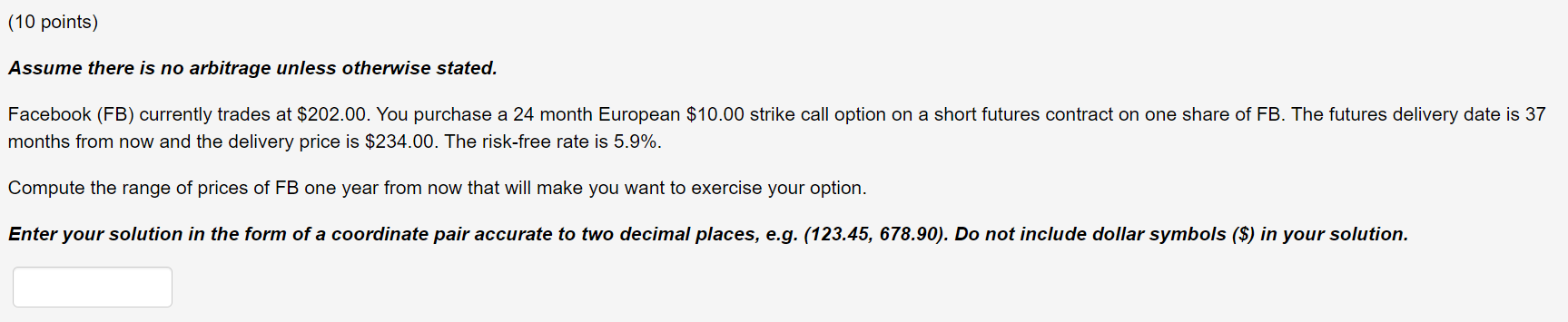

(10 points) Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $202.00. You purchase a 24 month European $10.00 strike call option on a short futures contract on one share of FB. The futures delivery date is 37 months from now and the delivery price is $234.00. The risk-free rate is 5.9%. Compute the range of prices of FB one year from now that will make you want to exercise your option. Enter your solution in the form of a coordinate pair accurate to two decimal places, e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution. (10 points) Assume there is no arbitrage unless otherwise stated. Facebook (FB) currently trades at $202.00. You purchase a 24 month European $10.00 strike call option on a short futures contract on one share of FB. The futures delivery date is 37 months from now and the delivery price is $234.00. The risk-free rate is 5.9%. Compute the range of prices of FB one year from now that will make you want to exercise your option. Enter your solution in the form of a coordinate pair accurate to two decimal places, e.g. (123.45, 678.90). Do not include dollar symbols ($) in your solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts