Question: Assuming markets are operating efficiently, use the current Information to answer the question. Current Market Information: Zero Coupon US Treasury Bond Prices (m=1) Maturity_(Yrs). Quoted

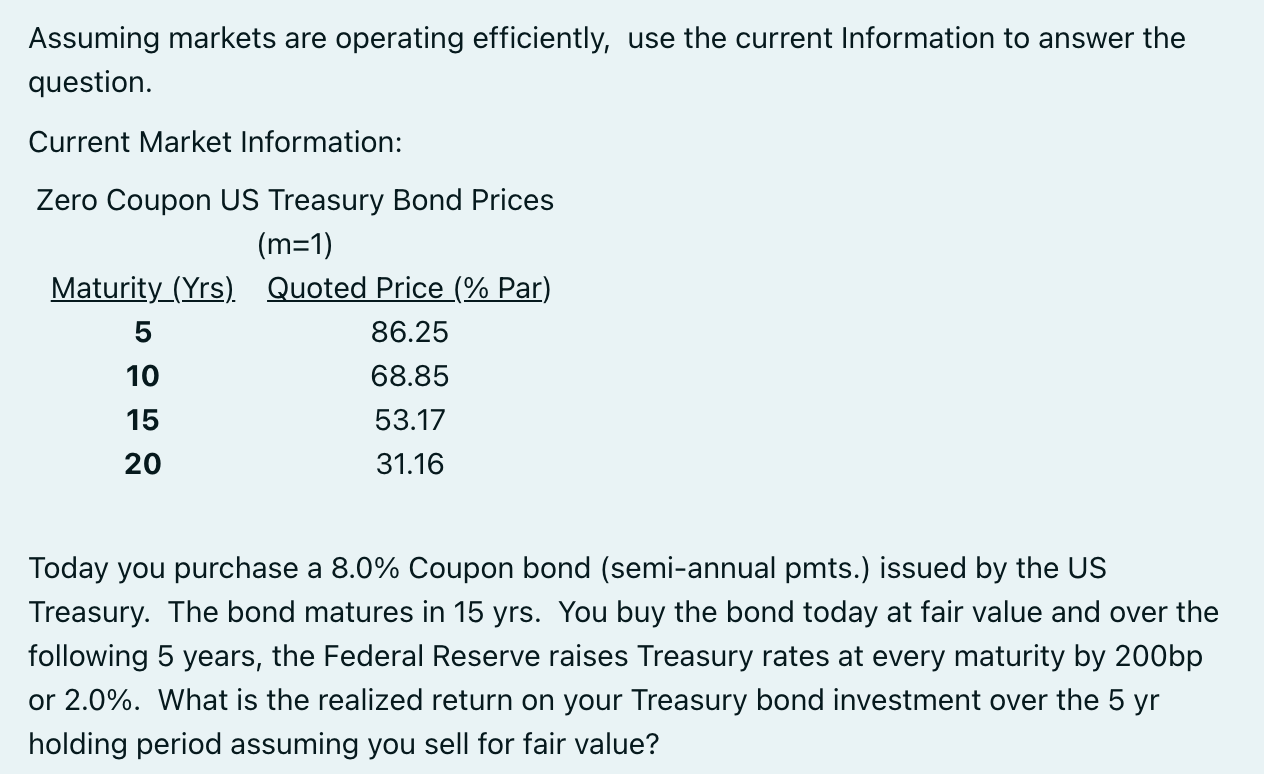

Assuming markets are operating efficiently, use the current Information to answer the question. Current Market Information: Zero Coupon US Treasury Bond Prices (m=1) Maturity_(Yrs). Quoted Price (% Par) 5 86.25 10 68.85 15 53.17 20 31.16 Today you purchase a 8.0% Coupon bond (semi-annual pmts.) issued by the US Treasury. The bond matures in 15 yrs. You buy the bond today at fair value and over the following 5 years, the Federal Reserve raises Treasury rates at every maturity by 200bp or 2.0%. What is the realized return on your Treasury bond investment over the 5 yr holding period assuming you sell for fair value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts