Question: please answer question Q11. a guaranteed thumps up for correct working and answer. thank you. Currently, Company ( mathrm{ABC} ) has the following financial parameters:

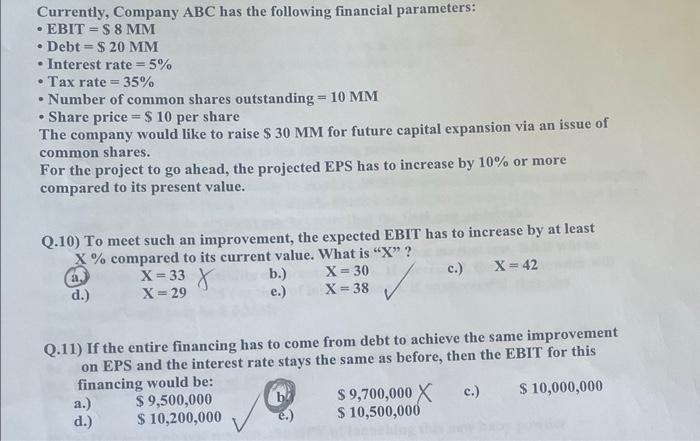

Currently, Company \\( \\mathrm{ABC} \\) has the following financial parameters: - \\( \\mathrm{EBIT}=\\$ 8 \\mathrm{MM} \\) - Debt \\( =\\$ 20 \\mathrm{MM} \\) - Interest rate \=mathbf5 - Tax rate \=35 - Number of common shares outstanding \\( =10 \\mathrm{MM} \\) - Share price \\( =\\$ 10 \\) per share The company would like to raise \\( \\$ 30 \\mathrm{MM} \\) for future capital expansion via an issue of common shares. For the project to go ahead, the projected EPS has to increase by \10 or more compared to its present value. Q.10) To meet such an improvement, the expected EBIT has to increase by at least \mathrmX compared to its current value. What is \" \\( \\mathrm{X} \\) \" ? (a) \\( \\mathrm{X}=33 \\) b.) \\( \\quad \\mathrm{X}=30 \\) c.) \\( \\quad \\mathrm{X}=42 \\) d.) \\( \\quad \\mathrm{X}=29 \\) e.) \\( \\mathrm{X}=38 \\) Q.11) If the entire financing has to come from debt to achieve the same improvement on EPS and the interest rate stays the same as before, then the EBIT for this financing would be: a.) \\( \\$ 9,500,000 \\) b. \\( \\$ 9,700,000 \\) c.) \\( \\$ 10,000,000 \\) d.) \\( \\$ 10,200,000 \\) e.) \\( \\$ 10,500,000 \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts