Question: Un 1 January 2018, Acho a wine merchant bought a small bottling and labeling machine from Edumark on hire purchase terms. The cash price

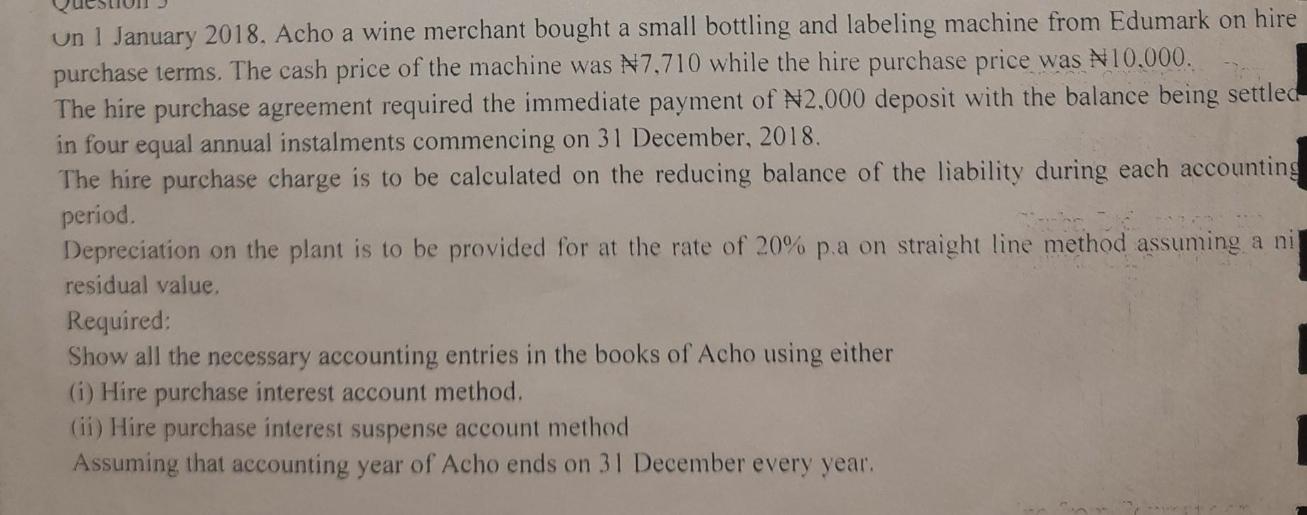

Un 1 January 2018, Acho a wine merchant bought a small bottling and labeling machine from Edumark on hire purchase terms. The cash price of the machine was N7,710 while the hire purchase price was N10,000. The hire purchase agreement required the immediate payment of N2,000 deposit with the balance being settled in four equal annual instalments commencing on 31 December, 2018. The hire purchase charge is to be calculated on the reducing balance of the liability during each accounting period. Depreciation on the plant is to be provided for at the rate of 20% p.a on straight line method assuming a ni residual value. Required: Show all the necessary accounting entries in the books of Acho using either (i) Hire purchase interest account method. (ii) Hire purchase interest suspense account method Assuming that accounting year of Acho ends on 31 December every year.

Step by Step Solution

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Total Interest Payable Hire Purchase Price Cash Price 100007710 2290 Amount of Installment Hire Purchase Price Down payment No of installments 1000020... View full answer

Get step-by-step solutions from verified subject matter experts