Question: Assuming that the two plans have the same risk as the firm, use the following capital budgeting techniques and the firm's cost of capital to

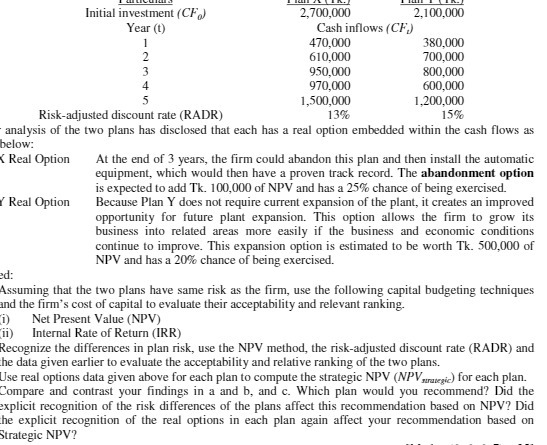

Initial investment (CF) Year (t) 2,700,000 2,100,000 Cash inflows (CF) 1 2 470,000 380,000 610,000 700,000 3 950,000 800,000 4 970,000 600,000 5 1,500,000 1,200,000 13% Risk-adjusted discount rate (RADR) 15% analysis of the two plans has disclosed that each has a real option embedded within the cash flows as below: X Real Option ed: Real Option At the end of 3 years, the firm could abandon this plan and then install the automatic equipment, which would then have a proven track record. The abandonment option is expected to add Tk. 100,000 of NPV and has a 25% chance of being exercised. Because Plan Y does not require current expansion of the plant, it creates an improved opportunity for future plant expansion. This option allows the firm to grow its business into related areas more easily if the business and economic conditions continue to improve. This expansion option is estimated to be worth Tk. 500,000 of NPV and has a 20% chance of being exercised. Assuming that the two plans have same risk as the firm, use the following capital budgeting techniques and the firm's cost of capital to evaluate their acceptability and relevant ranking. i) Net Present Value (NPV) (ii) Internal Rate of Return (IRR) Recognize the differences in plan risk, use the NPV method, the risk-adjusted discount rate (RADR) and the data given earlier to evaluate the acceptability and relative ranking of the two plans. Use real options data given above for each plan to compute the strategic NPV (NPVrategic) for each plan. Compare and contrast your findings in a and b, and c. Which plan would you recommend? Did the explicit recognition of the risk differences of the plans affect this recommendation based on NPV? Did the explicit recognition of the real options in each plan again affect your recommendation based on Strategic NPV?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts