Question: Assuming the CAPM approach is appropriate, compute the required rate of return for each of the following stocks, given a risk-free of 7% and

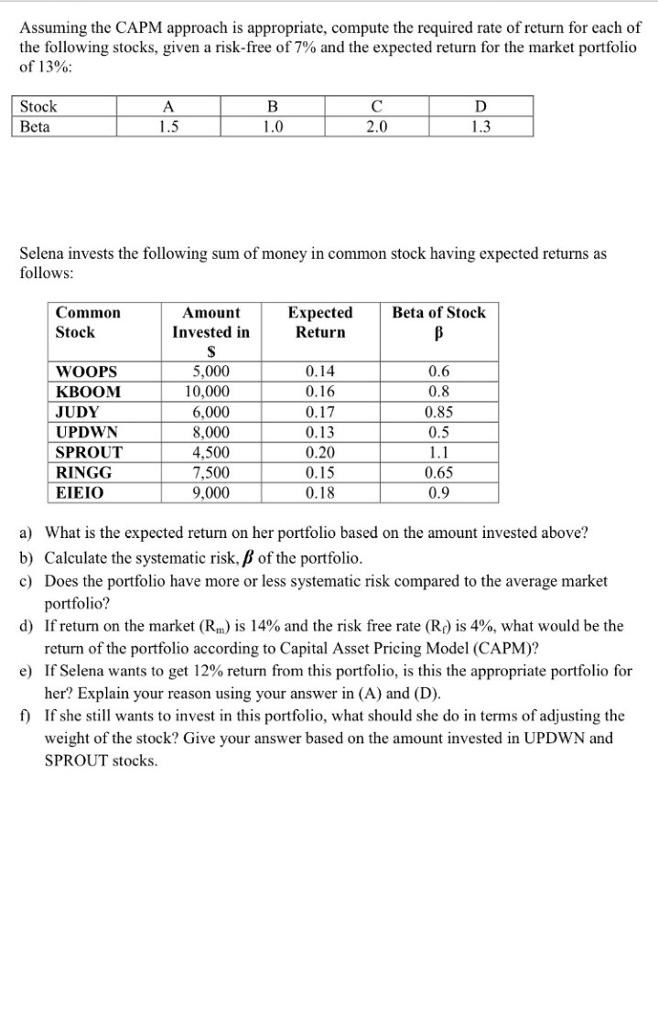

Assuming the CAPM approach is appropriate, compute the required rate of return for each of the following stocks, given a risk-free of 7% and the expected return for the market portfolio of 13%: Stock Beta A B C D 1.5 1.0 2.0 1.3 Selena invests the following sum of money in common stock having expected returns as follows: Common Stock Amount Invested in Expected Return Beta of Stock S WOOPS 5,000 0.14 0.6 KBOOM 10,000 0.16 0.8 JUDY 6,000 0.17 0.85 UPDWN 8,000 0.13 0.5 SPROUT 4,500 0.20 1.1 RINGG 7,500 0.15 0.65 9,000 0.18 0.9 a) What is the expected return on her portfolio based on the amount invested above? b) Calculate the systematic risk, of the portfolio. c) Does the portfolio have more or less systematic risk compared to the average market portfolio? d) If return on the market (R) is 14% and the risk free rate (R) is 4%, what would be the return of the portfolio according to Capital Asset Pricing Model (CAPM)? e) If Selena wants to get 12% return from this portfolio, is this the appropriate portfolio for her? Explain your reason using your answer in (A) and (D). f) If she still wants to invest in this portfolio, what should she do in terms of adjusting the weight of the stock? Give your answer based on the amount invested in UPDWN and SPROUT stocks.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts