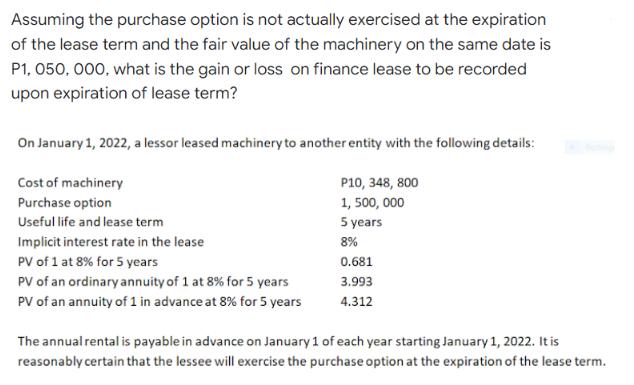

Question: Assuming the purchase option is not actually exercised at the expiration of the lease term and the fair value of the machinery on the

Assuming the purchase option is not actually exercised at the expiration of the lease term and the fair value of the machinery on the same date is P1,050,000, what is the gain or loss on finance lease to be recorded upon expiration of lease term? On January 1, 2022, a lessor leased machinery to another entity with the following details: Cost of machinery Purchase option Useful life and lease term Implicit interest rate in the lease PV of 1 at 8% for 5 years PV of an ordinary annuity of 1 at 8% for 5 years PV of an annuity of 1 in advance at 8% for 5 years P10, 348, 800 1, 500, 000 5 years 8% 0.681 3.993 4.312 The annual rental is payable in advance on January 1 of each year starting January 1, 2022. It is reasonably certain that the lessee will exercise the purchase option at the expiration of the lease term.

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

To calculate the gain or loss on finance lease upon the expiration of the lease term we need to comp... View full answer

Get step-by-step solutions from verified subject matter experts