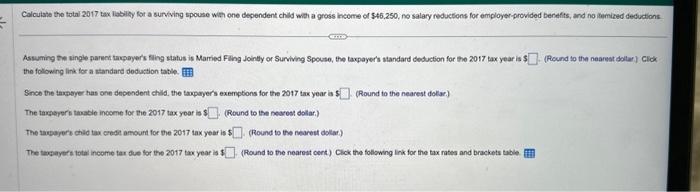

Question: Assuming the single parent tappayer's fing status is Married Filing Jointly or Surviving Spouse, the taxpayers standard deduction for the 2017 tax year is 4

Assuming the single parent tappayer's fing status is Married Filing Jointly or Surviving Spouse, the taxpayers standard deduction for the 2017 tax year is 4 (Pound to the neareat dollar) Clok the following link for a standard deduction tatle. Since the taxevyer has one dependent child, the tapperers exemptions for the 2017 tas year af (Round to the nearest dollac) The taveepers timadie income for the 2017 tax yoar is : (Round to the nesess dolar) The aapearers child tax erest atiount for the 2017 tax year is 5 (Round to the nearent dolat) The taceayers total income tar fue for the 2017tax year is 5 (Round to the nearest cent) Clok the following link for the tix rates and brackets table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts