Question: assuming the Walmart had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short

assuming the Walmart had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for the year ending January 31, 2016 (hereafter ,fiscal 2015)? explain

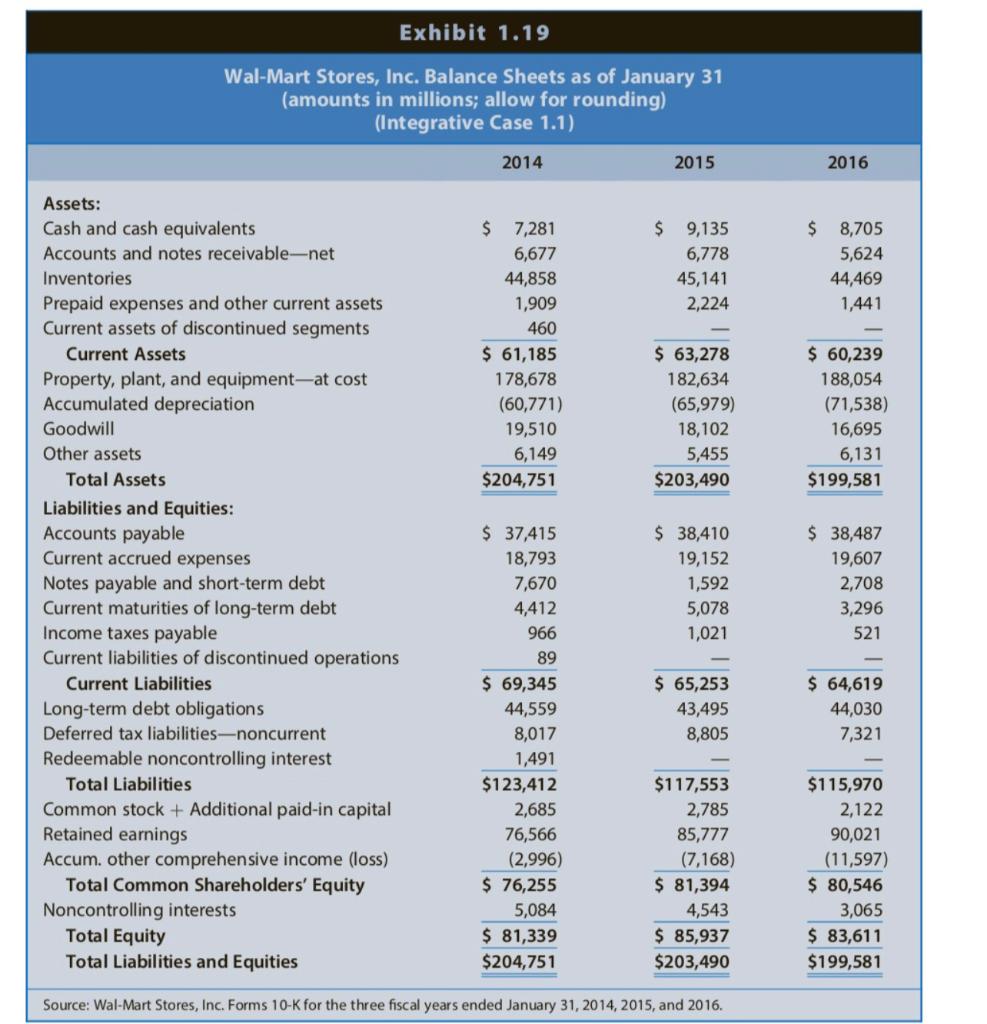

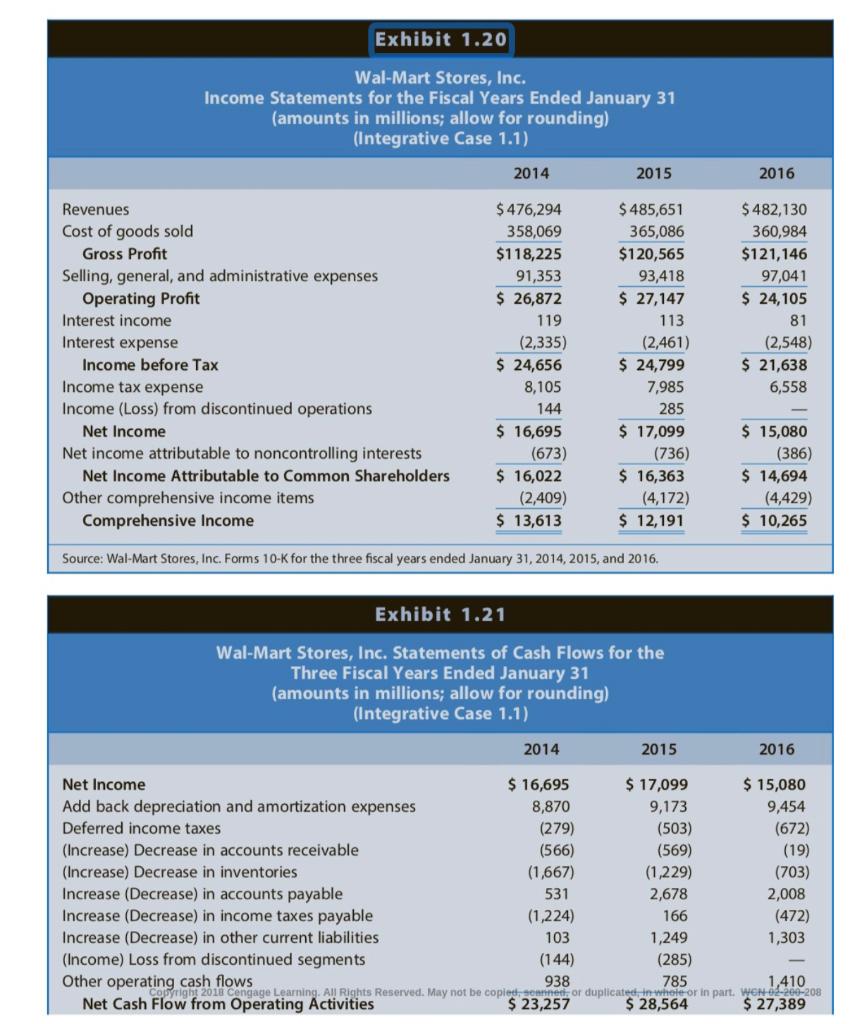

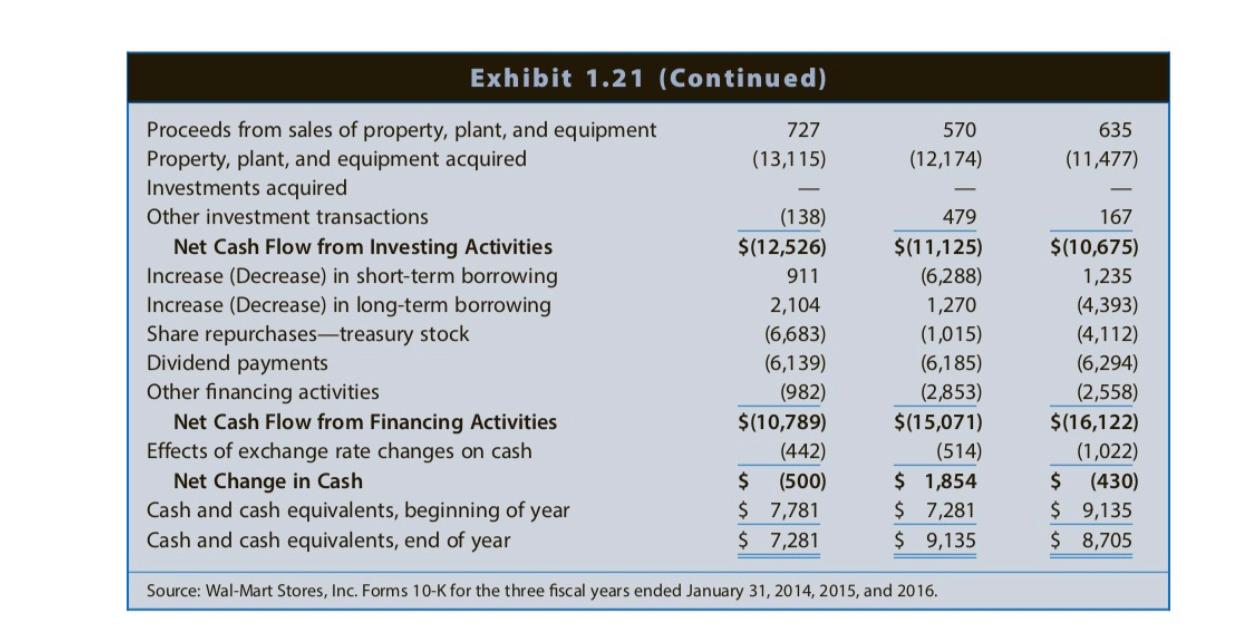

Exhibit 1.19 Wal-Mart Stores, Inc. Balance Sheets as of January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31, 2014, 2015, and 2016. Exhibit 1.20 Wal-Mart Stores, Inc. Income Statements for the Fiscal Years Ended January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31, 2014,2015, and 2016. Exhibit 1.21 Wal-Mart Stores, Inc. Statements of Cash Flows for the Three Fiscal Years Ended January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Net Income Add back depreciation and amortization expenses Deferred income taxes (Increase) Decrease in accounts receivable (Increase) Decrease in inventories Increase (Decrease) in accounts payable Increase (Decrease) in income taxes payable Increase (Decrease) in other current liabilities (Income) Loss from discontinued segments Other operating cash flows Net Cash Flow from Operating Activities Exhibit 1.19 Wal-Mart Stores, Inc. Balance Sheets as of January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31, 2014, 2015, and 2016. Exhibit 1.20 Wal-Mart Stores, Inc. Income Statements for the Fiscal Years Ended January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31, 2014,2015, and 2016. Exhibit 1.21 Wal-Mart Stores, Inc. Statements of Cash Flows for the Three Fiscal Years Ended January 31 (amounts in millions; allow for rounding) (Integrative Case 1.1) Net Income Add back depreciation and amortization expenses Deferred income taxes (Increase) Decrease in accounts receivable (Increase) Decrease in inventories Increase (Decrease) in accounts payable Increase (Decrease) in income taxes payable Increase (Decrease) in other current liabilities (Income) Loss from discontinued segments Other operating cash flows Net Cash Flow from Operating Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts