Question: aswered Question 37 Not yet graded / 5 pts One of your classmates has decided to analyze a pharmaceutical firm's risk for their project. They

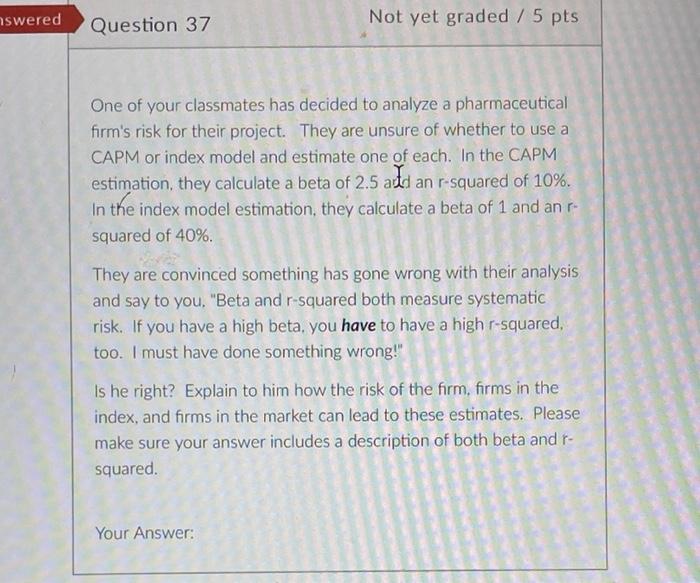

aswered Question 37 Not yet graded / 5 pts One of your classmates has decided to analyze a pharmaceutical firm's risk for their project. They are unsure of whether to use a CAPM or index model and estimate one of each. In the CAPM estimation, they calculate a beta of 2.5 add an r-squared of 10%. In the index model estimation, they calculate a beta of 1 and an r squared of 40%. They are convinced something has gone wrong with their analysis and say to you, "Beta and r-squared both measure systematic risk. If you have a high beta, you have to have a high r-squared, too. I must have done something wrong!" Is he right? Explain to him how the risk of the firm, firms in the index, and firms in the market can lead to these estimates. Please make sure your answer includes a description of both beta and r- squared Your Answer: aswered Question 37 Not yet graded / 5 pts One of your classmates has decided to analyze a pharmaceutical firm's risk for their project. They are unsure of whether to use a CAPM or index model and estimate one of each. In the CAPM estimation, they calculate a beta of 2.5 add an r-squared of 10%. In the index model estimation, they calculate a beta of 1 and an r squared of 40%. They are convinced something has gone wrong with their analysis and say to you, "Beta and r-squared both measure systematic risk. If you have a high beta, you have to have a high r-squared, too. I must have done something wrong!" Is he right? Explain to him how the risk of the firm, firms in the index, and firms in the market can lead to these estimates. Please make sure your answer includes a description of both beta and r- squared Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts