Question: At 5.56 percent interest, how long does it take (in years) to quadruple your money? Answer to two decimals. Investment X offers to pay you

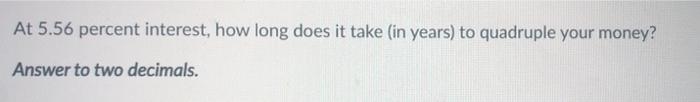

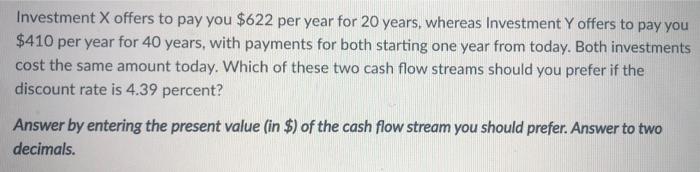

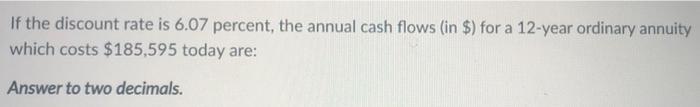

At 5.56 percent interest, how long does it take (in years) to quadruple your money? Answer to two decimals. Investment X offers to pay you $622 per year for 20 years, whereas Investment Y offers to pay you $410 per year for 40 years, with payments for both starting one year from today. Both investments cost the same amount today. Which of these two cash flow streams should you prefer if the discount rate is 4.39 percent? Answer by entering the present value (in $) of the cash flow stream you should prefer. Answer to two decimals. If the discount rate is 6.07 percent, the annual cash flows (in $) for a 12-year ordinary annuity which costs $185,595 today are: Answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts