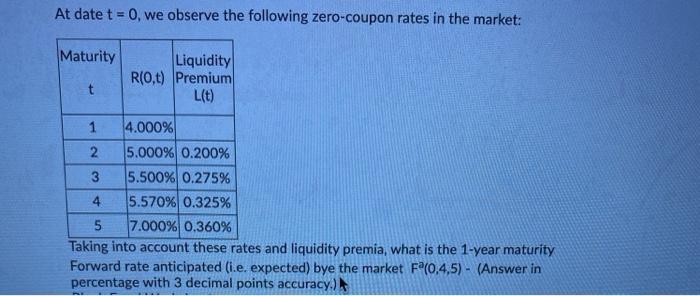

Question: At date t = 0, we observe the following zero-coupon rates in the market: Maturity Liquidity R(0,t) Premium L(t) t 1 4.000% 2 5.000% 0.200%

At date t = 0, we observe the following zero-coupon rates in the market: Maturity Liquidity R(0,t) Premium L(t) t 1 4.000% 2 5.000% 0.200% 3 5.500% 0.275% 4 5.570% 0.325% 5 7.000% 0.360% Taking into account these rates and liquidity premia, what is the 1-year maturity Forward rate anticipated i.e. expected) bye the market F(0,4,5) - (Answer in percentage with 3 decimal points accuracy.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts