Question: please answer number 2 and 3 il Verizon LTE ( 70% 12:35 PM Chapter 2 questions.pdf X ... Questions and Short Problems: Chapter 2 1.

please answer number 2 and 3

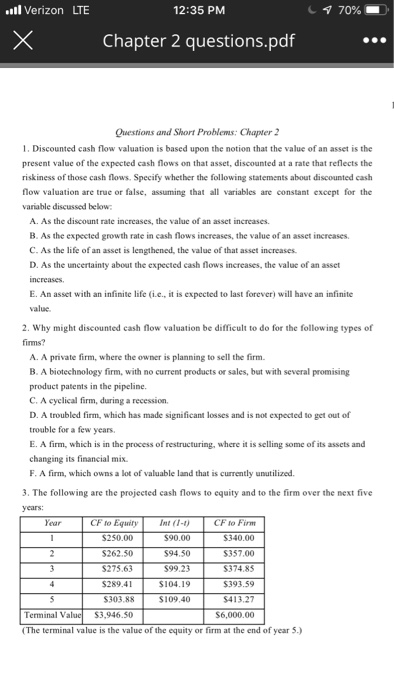

please answer number 2 and 3il Verizon LTE ( 70% 12:35 PM Chapter 2 questions.pdf X ... Questions and Short Problems: Chapter 2 1. Discounted cash flow valuation is based upon the notion that the value of an asset is the present value of the expected cash flows on that asset, discounted at a rate that reflects the riskiness of those cash flows. Specify whether the following statements about discounted cash flow valuation are true or false, assuming that all variables are constant except for the variable discussed below A As the discount rate increases, the value of an asset increases B. As the expected growth rate in cash flows increases, the value of an asset increases C. As the life of an asset is lengthened, the value of that asset increases D. As the uncertainty about the expected cash flows increases, the value of an asset increases E. An asset with an infinite life (.c., it is expected to last forever) will have an infinite value 2. Why might discounted cash flow valuation be difficult to do for the following types of firms? A. A private firm, where the owner is planning to sell the firm. B. A biotechnology firm, with no current products or sales, but with several promising product patents in the pipeline. C. A cyclical firm, during a recession. D. A troubled firm, which has made significant losses and is not expected to get out of trouble for a few years. E. A firm, which is in the process of restructuring, where it is selling some of its assets and changing its financial mix F. A firm, which owns a lot of valuable land that is currently unutilized 3. The following are the projected cash flows to equity and to the firm over the next five Year ICF to Equity Int(1-1) CF to Firm $250.00 $90.00 $140.00 $262.50 $94.50 $357.00 $275,63 $99.23 $374.85 $289.41 $104.19 $393.59 S303.88 $109.40 $413.27 Terminal Value $3.946.50 S6,000.00 (The terminal value is the value of the equity or firm at the end of year 5.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts