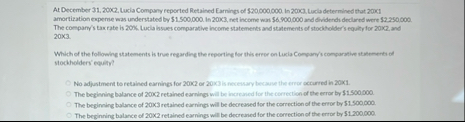

Question: At December 3 1 , 2 0 0 C . , Uucia Company reported Retained Earnings of $ 2 0 , 0 0 0 0

At December C Uucia Company reported Retained Earnings of $ In Lucla determined that ck amortiration expeme was understated by $$ in ret income was $ and dividerdi dedured were $: The compary's tax rate is Lucla haves comparative income statements and statements of stoditolder's equity for and

Which of the following statements is true regarding the reporing for this errer on Lucia Compary's conparative atanmerti of stockholders' equity?

No adjastment to retained earnings for C or is necewary because the ernor acrarred in

The beginning balance of C retained earnings will be harcated for the correction of the error by $

The beginning balance of retained earninger will be decreased for the correction of the error by $

The beginning balance of retained earnings will be decreaned for the correction of the error by

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock