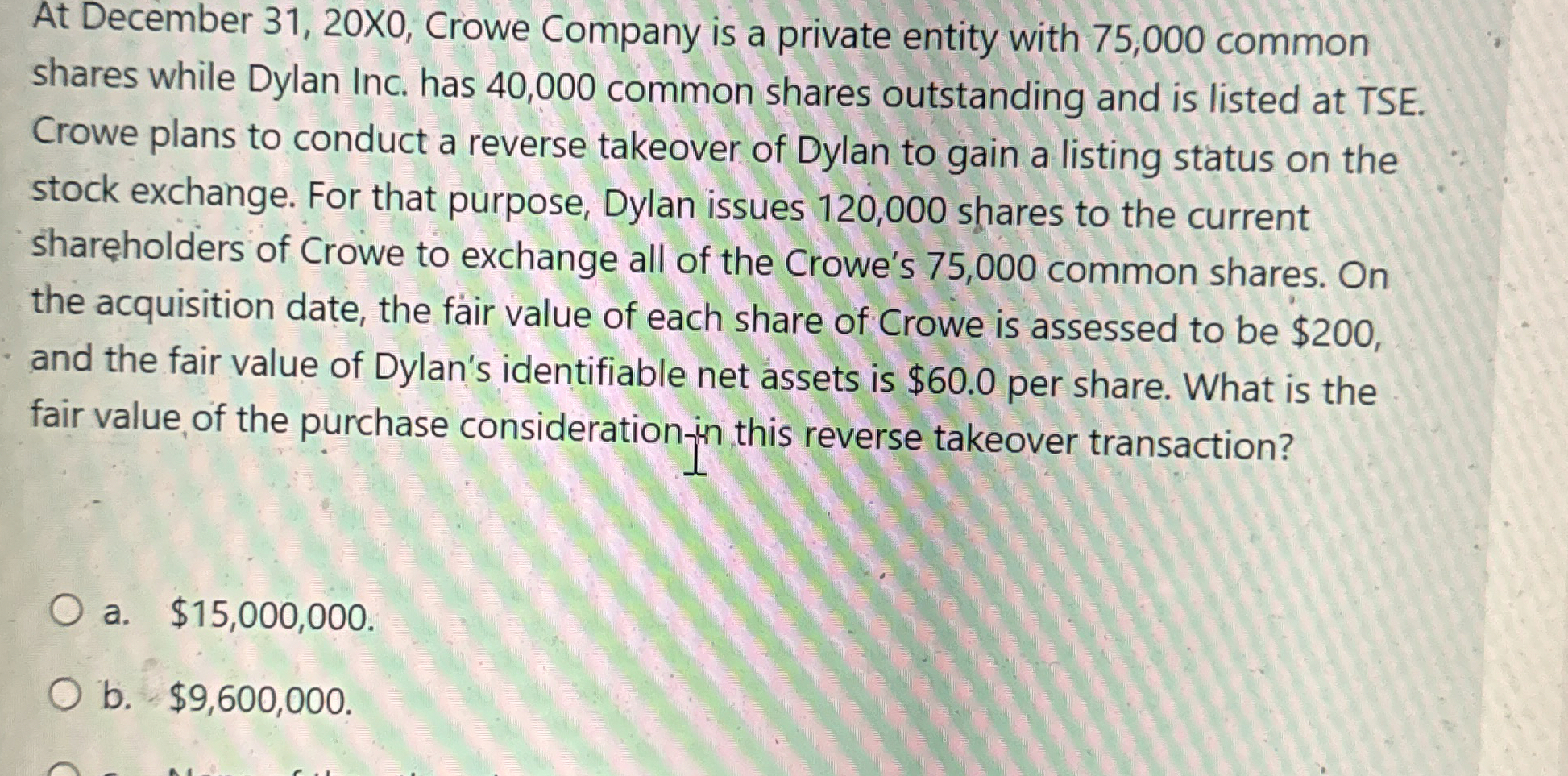

Question: At December 3 1 , 2 0 X 0 , Crowe Company is a private entity with 7 5 , 0 0 0 common shares

At December X Crowe Company is a private entity with common

shares while Dylan Inc. has common shares outstanding and is listed at TSE.

Crowe plans to conduct a reverse takeover of Dylan to gain a listing status on the

stock exchange. For that purpose, Dylan issues shares to the current

shareholders of Crowe to exchange all of the Crowe's common shares. On

the acquisition date, the fair value of each share of Crowe is assessed to be $

and the fair value of Dylan's identifiable net assets is $ per share. What is the

fair value of the purchase consideration in this reverse takeover transaction?

a $

b $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock