Question: Chapter 6 Mini Case Situation & Setup You have now completed several ways to evaluate the financial condition of an orgainization and this means your

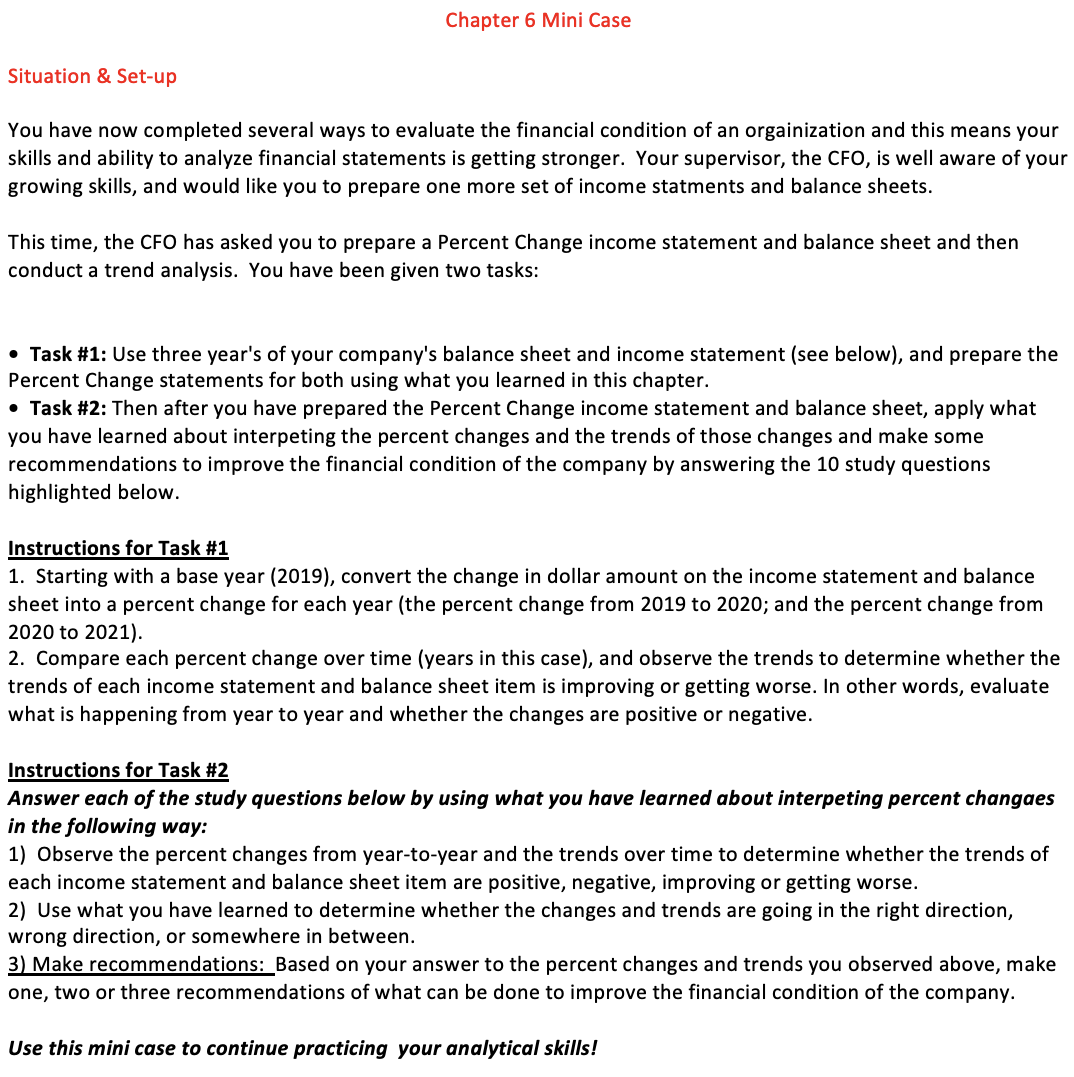

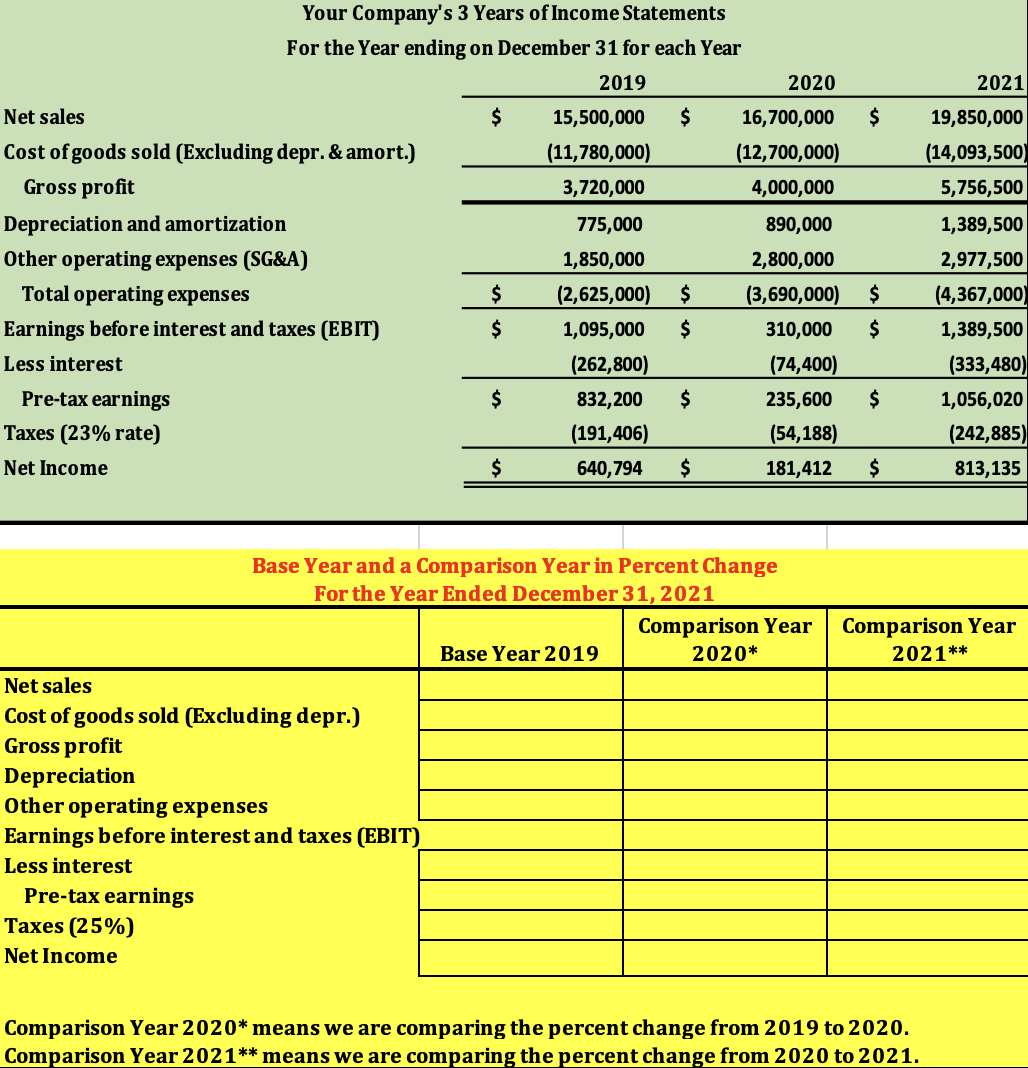

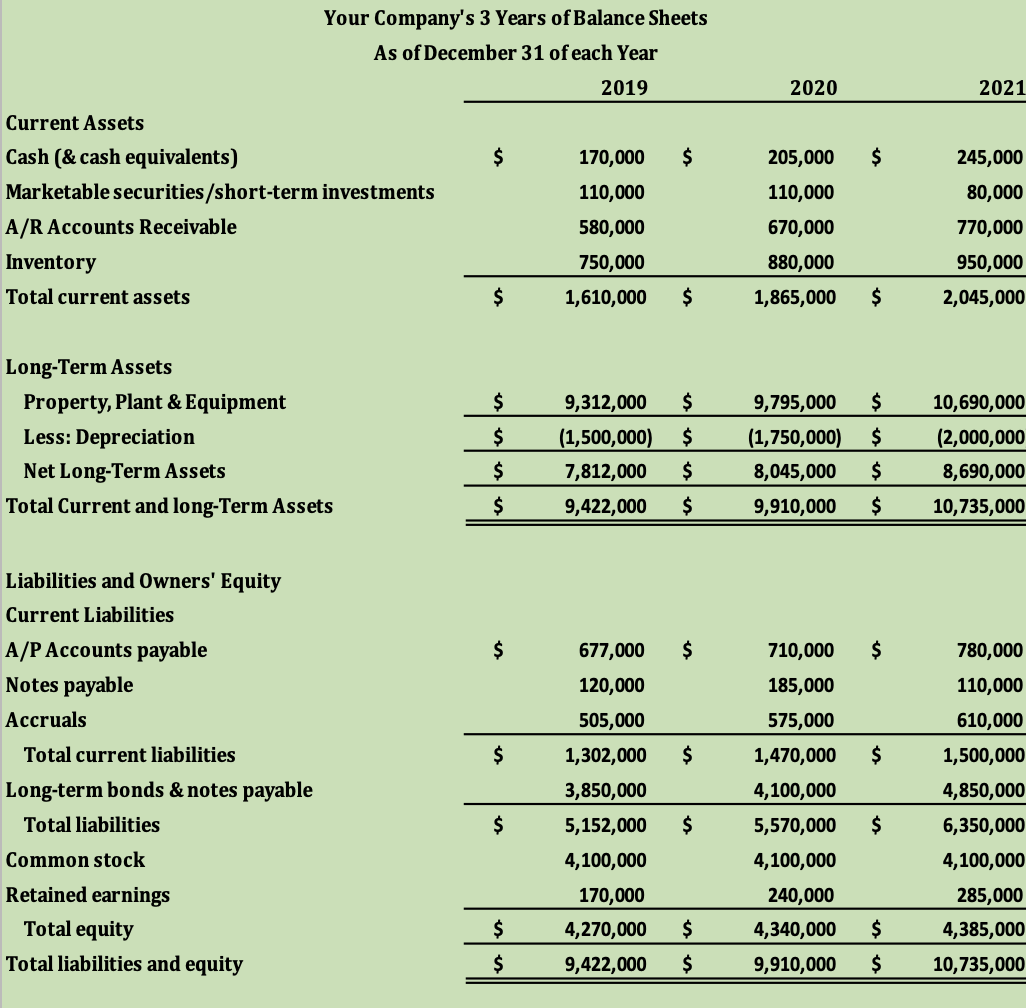

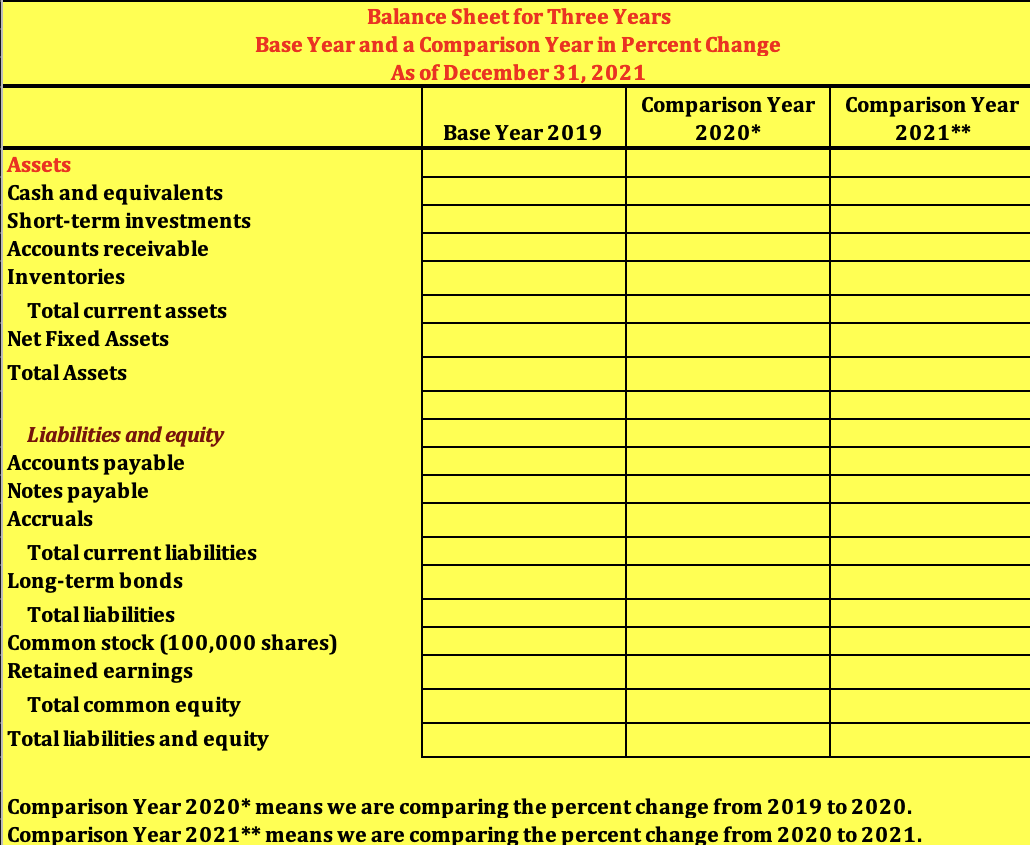

Chapter 6 Mini Case Situation & Setup You have now completed several ways to evaluate the financial condition of an orgainization and this means your skills and ability to analyze financial statements is getting stronger. Your supervisor, the CFO, is well aware of your growing skills, and would like you to prepare one more set of income statments and balance sheets. This time, the CFO has asked you to prepare a Percent Change income statement and balance sheet and then conduct a trend analysis. You have been given two tasks: a Task #1: Use three year's of your company's balance sheet and income statement (see below), and prepare the Percent Change statements for both using what you learned in this chapter. I Task #2: Then after you have prepared the Percent Change income statement and balance sheet, apply what you have learned about interpeting the percent changes and the trends of those changes and make some recommendations to improve the financial condition of the company by answering the 10 study questions highlighted below. Instructions for Task #1 1. Starting with a base year (2019), convert the change in dollar amount on the income statement and balance sheet into a percent change for each year (the percent change from 2019 to 2020; and the percent change from 2020 to 2021). 2. Compare each percent change over time (years in this case), and observe the trends to determine whether the trends of each income statement and balance sheet item is improving or getting worse. In other words, evaluate what is happening from year to year and whether the changes are positive or negative. Instructions for Task #2 Answer each of the study questions below by using what you have learned about interpeting percent changaes in the following way: 1) Observe the percent changes from yeartoyear and the trends over time to determine whether the trends of each income statement and balance sheet item are positive, negative, improving or getting worse. 2) Use what you have learned to determine whether the changes and trends are going in the right direction, wrong direction, or somewhere in between. 3! Make recommendations: Based on your answer to the percent changes and trends you observed above, make one, two or three recommendations of what can be done to improve the financial condition of the company. Use this mini case to continue practicing your analytical skills! Your Company's 3 Years of Income Statements For the Year ending on December 31 for each Year 2019 2020 2021 Net sales 5 15,500,000 5 16,700,000 5 13,350,000 Cost of goods sold (Excluding depr. &amort.] (11,780,000) (12,700,000) (14,093, 500) Gross prot 3,720,000 4,000,000 5,756,500 Depreciation and amortization 775,000 890,000 1, 389, 500 Other operating expenses (SGSzA) 1,850,000 2,800,000 2,97 7,500 Total operating expenses 5 (2,625,000) 5 (3,690,000) 5 (4,367,000) Earnings before interest and taxes (EBlT) 5 1,095,000 S 310,000 5 1,389,500 Less interest (262,800) (74,400) (333,480) Pretax earnings 5 832, 200 S 235, 600 5 1,05 6,020 Taxes (23% rate] (191,406) (54,133) (242,335) Net Income 5 640, 794 S 181,412 5 813,135 Base Year and a Comparison Year in Percent Change For the Year Ended December 3 1, 2 02 1 Comparison Year Comparison Year BaseYear2019 2020* 2021** Netsales Cost ofgoods sold (Excluding dept) Gross profit Depreciation Other operating expenses Earnings before interest and taxes [EBIT] Less interest Pre-tax earnings Taxes (2 5%) Net Income Comparison Year 2 02 0* means we are comparing the percent change from 2 0 19 to 2 02 0. Comparison Year 2 02 1** means we are comparing the percent change from 2 02 0 to 2 02 1. Your Company's 3 Years of Balance Sheets As of December 31 of each Year 2019 2020 2021 Current Assets Cash (& cash equivalents) 170,000 205,000 S 245,000 Marketable securities/short-term investments 110,000 110,000 80,000 A/R Accounts Receivable 580,000 670,000 770,000 Inventory 750,000 880,000 950,000 Total current assets $ 1,610,000 $ 1,865,000 $ 2,045,000 Long-Term Assets Property, Plant & Equipment $ 9,312,000 $ 9,795,000 $ 10,690,000 Less: Depreciation (1,500,000) (1,750,000) $ (2,000,000 in un Net Long-Term Assets 7,812,000 un 8,045,000 un 8,690,000 Total Current and long-Term Assets 9,422,000 $ 9,910,000 $ 10,735,000 Liabilities and Owners' Equity Current Liabilities A/P Accounts payable ur 677,000 $ 710,000 $ 780,000 Notes payable 120,000 185,000 110,000 Accruals 505,000 575,000 610,000 Total current liabilities $ 1,302,000 $ 1,470,000 $ 1,500,000 Long-term bonds & notes payable 3,850,000 4,100,000 4,850,000 Total liabilities 5,152,000 $ 5,570,000 $ 6,350,000 Common stock 4,100,000 4,100,000 4,100,000 Retained earnings 170,000 240,000 285,000 Total equity 4,270,000 un 4,340,000 un 4,385,00 Total liabilities and equity 9,422,000 S 9,910,000 10,735,000Balance Sheet for Three Years Base Year and a Comparison Year in Percent Change Assets Cash and equivalents Short-term investments Accounts receivable Inventories Total current assets Net Fixed Assets Total Assets Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total liabilities Common stock (100,000 shares] Retained earnings Total common equity Total liabilities and equity As ofDecember 3 1, 202 1 Comparison Year BaseYear2019 2020* Comparison Year 202 1** Comparison Year 2 02 0* means we are comparing the percent change from 2 0 19 to 2 02 0. Comparison Year 2 02 1** means we are comparing the percent change from 2020 to 202 1. Study Question #1 - Now that you have prepared a percent change income statement for three years, what do the changes in sales, Cost of goods sold and gross profit tell you? Are the changes in each the same, or are cost of goods sold rising faster relative to sales? Your Answer: Study Question #2 - Look again at the percent change income statement for three years, what do the changes in operating expenses, EBIT, interest, taxes, and net income tell you? Are the changes in each the same, or are the changing at different rates? Your Answer: Study Question #3 - Looking again at the three years of percent change income statements, give at least three (3) recommendations that would help improve your company's financial performance. Your Answer: Study Question #4 - Now that you have prepared three years of percent change balance sheets, what do the changes tell you about the company's current assets? Are the changes in current assets running about the same as sales? If not, based on everything you have learned thus far, can you provide a possible explanation? Your Answer:Study Question #5 - Looking again at the three years of percent change balance sheets, what do the changes tell you about the company's long term, or fixed assets? Are the changes running about the same as sales? If not, based on everything you have learned thus far, can you provide possible explanation? Your Answer: Study Question #6 - Looking again at the three years of percent change balance sheets, what do the changes tell you about the company's current liabilities? Are the changes similar to the changes in current assets and sales? If not, based on everything you have learned thus far, can you provide a possible explanation? Your Answer: Study Question #7 - Looking again at the three years of percent change balance sheets, what do the changes tell you about the company's long- term debt or long-term bonds? Are the changes running about the same as long-term or fixed assets? How about sales? If not, based on everything you have learned thus far, can you provide a possible explanation? Your Answer:Study Question #8 - Looking again at the three years of percent change balance sheets, what do the changes tell you about the company's common stock and retained earnings? Are the changes running about the same as long-term or fixed assets? How about sales? If not, based on everything you have learned thus far, can you provide a possible explanation? Your Answer: Study Question #9 - List at least two recommendations to improve future changes in assets (current and fixed) on the balance sheet. Tip: try to think of at least two of the accounts/items on the asset side of the balance that could be improved in the future relative to sales. Your Answer: Study Question #10 - List at least two recommendations to improve future changes in the liability and equity side of the balance sheet. Tip: try to think of at least two of the accounts/items on the liability and equity side of the balance that could be improved in the future relative to assets and sales. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts