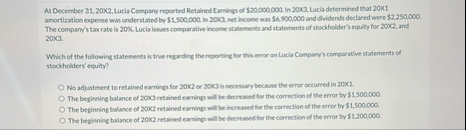

Question: At December 3 1 , 2 0 x 2 , Lucia Company reported Retained Earnings of $ 2 0 0 0 0 , 0 0

At December x Lucia Company reported Retained Earnings of $ In X Lucla determined that X amortizaticn expense was understated by $ in c net income was $ and dividends declared were $ The company's tax rate is k Lucia iswes comparative incone statements and statements of stochholder's equity for C and

Which of the following statements is true regarding the reporting for this error on Lucia Companys compunative statements of stockholders' equity?

No adjustment to retained earningt for K er Cl is necesuary because the error occurred in

The beginning balance of Cl retained earnings will be decrased for the correction of the error by $

The beginning balance of retained eamings will be increased lor the correction of the error by $

The beginning balance of retained earnings mill be decreased for the correction of the error by $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock