Question: At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a nine-year operating lease agreement. The contract calls for

At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a nine-year operating lease agreement. The contract calls for quarterly rent payments of $39,000 each. The office building was acquired by Lakeside at a cost of $3.4 million and was expected to have a useful life of 25 years with no residual value. What will be the effect of the lease on LTTs earnings for the first year (ignore taxes)?

LTT reduces it's earnings by $_______

| At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a eleven-year operating lease agreement. The contract calls for quarterly rent payments of $41,000 each. The office building was acquired by Lakeside at a cost of $3.6 million and was expected to have a useful life of 30 years with no residual value. |

| What will be the effect of the lease on Lakesides earnings for the first year (ignore taxes)? Lakeside Increases it's earnings by _________

|

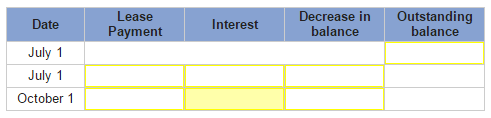

Lease Decrease in Outstanding Payment Interest Decrease in Date July 1 July 1 October 1 balance balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts